Loan against stock exchange securities The following are the drawbacks of advancing money against stock- exchange securities : (i) Liability to pay in case of partly-up shares. In case partly paid shares have been transferred in the banker’s name and the company makes a call, the banker will have to […]

Read moreLatest Posts

Loan against Documents of Title of Goods

Loan against Documents of Title of Goods Documents which in the ordinary course of trade, are regarded as proof of the possession or control of the goods, are called documents of title. They authorize the holder thereof to transfer or receive goods which are mentioned therein. Bill of lading, dock […]

Read moreLoan against Supply Bills

Loan against Supply Bills Loan against Supply Bills: The Government and Semi-government Departments or institutions make their purchases from the market by inviting tenders. The person or contractor who quotes the lowest price, gets the order for supply of the goods or completing the work. Before the goods are finally […]

Read moreWhat is Dispatch

What is Dispatch What is Dispatch: Definitions Dispatch as verb (transitive): 1. to send off promptly, as to a destination or to perform a task 2. to discharge or complete (a task, duty, etc) promptly 3. (informal) to eat up quickly 4. to murder or execute Dispatch as noun […]

Read moreThe Bank Companies Act 1991

The Bank Companies Act 1991 The Bank Companies Act 1991: This is the act which is meant for Commercial Banks and the Central Bank of the country as well. It is mandatory for all banks to abide by the provisions of this Act. This Act has given necessary power to the […]

Read more

SIBL Credit Card

SIBL Credit Card SIBL Credit Card:In today’s modern world credit card is very extensively used mode of financial transaction and it is widely known as “ Plastic Money”. It has created an immense impact in the life of the people all over the world.The same trend is being followed […]

Read more

Bank of America Auto loan

Bank of America Auto loan Bank of America Auto loan: Auto loan benefits Whether you’re buying a new or used car or refinancing, our comprehensive auto loan services and benefits can help steer you in the right direction. Customer benefit 0.15% APR discount Bank of America customer? Shop with […]

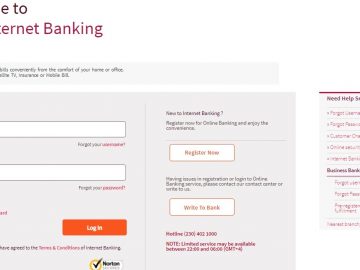

Read moreAib Internet Banking

Aib Internet Banking At AIB , we know running a business means being fast,flexible and available at all times , Therefore , AIB designed Internet Banking to put you in the driver seat and manage your banking business anytime and anywhere . The Internet Banking provides you a fast , […]

Read moreBai Murabaha

Bai Murabaha The term ‘Bai-Murabaha’ has been derived from Arabic words ﻊﻴﺒ and ﺢﺑﺭ (Bai’un and Ribhun). The word ﻊﻴﺒ means purchase and sale and the word ﺢﺑﺭ means an agreed upon profit. ﺍﻠﻤﺮﺍﺒﺢ ﻊﻴﺒ ‘Bai-Murabaha’ means sale on agreed upon profit. Bai-Murabaha may be defined as a contract between […]

Read moreIslamic Banking- Bai Mechanism

Islamic Banking- Bai Mechanism Bai Mechanism Bai means purchase and sale of goods in cash or on credit or in advance at an agreed upon profit, which may or may not be disclosed to the client. Majority of investments of Islamic banks are extended through this mechanism. A good number […]

Read moreHow to define central bank

How to define central bank Meaning of central bank Central banking in the main monetary institution which is at the apex of the monetary and banking structure of a country.It is the leader of a money market and such as controls, regulates and supervises the activities of all commercial banks. […]

Read more

ABSA Flexi Account

ABSA Flexi Account 1. Flexi Account A flexible transactional account Flexi Account offers value-added services to customers services including 24-hour health and medical advice, funeral cover and legal assistance. Not to give extra charge required for these services To pay for your goods and services 24-hour debit card enables you […]

Read moreSteps to open a Bank Account

Steps to open a Bank Account At present Banks have emerged as essential financial institutions. Banks make available a safe environment and help us manage our financial transactions. To gain professional banking service it is compulsory for every individual to open a bank account. Opening a bank account is not […]

Read more

What is Bank

What is Bank Bank is a financial institution or corporation which deals with money and its substitutes; it also provides other financial services. Banks accept deposits and make loans and obtain a profit from the difference in the interest paid to lenders (depositors) and charged to borrowers, respectively. It is […]

Read more

Objectives of Bank

Objectives of Bank Objectives and importance of Bank Bank has various objectives as per other financial organizations. But banking organization view point is exceptional than others. The objectives of bank can be viewed from three different perspectives: 1) Objective from the view point of Bank owners, 2) Objective from the […]

Read more