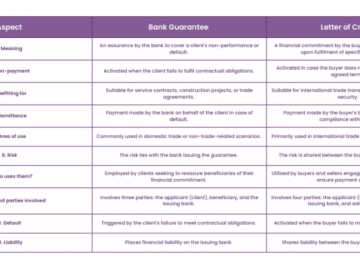

Difference Between Letter of Credit and Bank Guarantee A Letter of Credit (LC) and a Bank Guarantee are both financial instruments used in international trade and business transactions to mitigate risks, but they serve different purposes and function differently. 1. Purpose Letter of Credit (LC): An LC is primarily used […]

Read more