20 Banks of Australian bank Association

AMP

AMP Bank Limited

Locked Bag 5059

Parramatta NSW 2150

or the replied paid address:

Reply Paid 79702

PARRAMATTA NSW 2124

AMP Bank Limited

AMP Bank Limited, commonly referred to as AMP Bank, is a leading financial institution in Australia. With a strong focus on providing innovative banking solutions and exceptional customer service, AMP Bank has established itself as a trusted name in the Australian banking industry. In this article, we will explore the history, products and services, customer benefits, and future prospects of AMP Bank.

Outline:

- Introduction

- History of AMP Bank

- Products and Services

- Home Loans

- Savings Accounts

- Transaction Accounts

- Credit Cards

- Personal Loans

- Customer Benefits

- Competitive Interest Rates

- Flexible Loan Options

- Digital Banking Solutions

- Dedicated Customer Support

- Commitment to Sustainability

- Future Prospects

- Conclusion

- FAQs

Article:

Introduction

In the competitive landscape of Australian banking, AMP Bank Limited has emerged as a trusted and customer-centric financial institution. With its extensive range of products and services, AMP Bank caters to the diverse financial needs of individuals and businesses alike. Let’s delve deeper into the history, offerings, customer benefits, and future prospects of this esteemed institution.

History of AMP Bank

AMP Bank has a rich history that dates back to its establishment in 1849. Originally known as the Australian Mutual Provident Society, AMP Bank started as a life insurance company. Over the years, the institution expanded its operations to include banking services and evolved into AMP Limited, a renowned financial services company in Australia. In 1998, AMP Bank was established as a separate entity within the AMP Group to provide banking solutions to its customers.

Products and Services

AMP Bank offers a wide range of financial products and services tailored to meet the diverse needs of its customers. Whether it’s purchasing a home, saving for the future, managing day-to-day transactions, or fulfilling personal financial goals, AMP Bank has a solution for everyone.

- Home Loans: AMP Bank provides competitive home loan options, including variable and fixed-rate mortgages, construction loans, and investment property loans. With flexible terms and personalized service, customers can find the right loan to suit their individual requirements.

- Savings Accounts: AMP Bank offers various savings accounts designed to help customers grow their savings while providing easy access to funds. From high-interest savings accounts to term deposits, AMP Bank ensures that customers can save with confidence.

- Transaction Accounts: With a range of transaction accounts, AMP Bank makes everyday banking convenient and hassle-free. Customers can enjoy features such as fee-free ATM withdrawals, online and mobile banking, and competitive transaction fees.

- Credit Cards: AMP Bank’s credit card options cater to different lifestyles and financial needs. From rewards programs to low-rate cards, customers can choose the card that aligns with their spending habits and financial goals.

- Personal Loans: Whether it’s for a new car, home renovations, or a dream holiday, AMP Bank offers personal loans with flexible repayment options and competitive interest rates. This enables customers to achieve their goals without compromising their financial stability.

Customer Benefits

AMP Bank is committed to delivering value to its customers through a range of benefits and features that enhance their banking experience.

- Competitive Interest Rates: AMP Bank strives to offer competitive interest rates across its product range, ensuring customers can maximize their savings and minimize their borrowing costs.

- Flexible Loan Options: With flexible loan terms and repayment options, AMP Bank empowers customers to tailor their loans to suit their unique circumstances. This flexibility allows for easier financial management and greater control over their

AMP Bank Limited

AMP Bank Limited is a renowned financial institution in Australia that offers a wide range of banking services to individuals, businesses, and corporations. With its strong focus on customer satisfaction and innovative financial solutions, AMP Bank has established itself as a trusted and reliable banking partner for thousands of Australians.

Table of Contents

- Introduction

- History of AMP Bank Limited

- Products and Services Offered

- 3.1 Home Loans

- 3.2 Savings Accounts

- 3.3 Transaction Accounts

- 3.4 Personal Loans

- 3.5 Credit Cards

- 3.6 Business Banking

- Digital Banking Solutions

- 4.1 Online Banking

- 4.2 Mobile Banking

- 4.3 Financial Tools and Apps

- AMP Bank’s Commitment to Customer Service

- Community Engagement and Corporate Social Responsibility

- Financial Stability and Industry Recognition

- Conclusion

- Frequently Asked Questions (FAQs)

- 9.1 How can I open an account with AMP Bank?

- 9.2 What are the interest rates offered on home loans?

- 9.3 Does AMP Bank offer business loans?

- 9.4 Can I access my AMP Bank accounts through mobile banking?

- 9.5 How does AMP Bank support the local community?

1. Introduction

In this article, we will explore the features, products, and services provided by AMP Bank Limited, a prominent financial institution in Australia. AMP Bank has been operating for several decades, catering to the diverse financial needs of its customers. From home loans to business banking solutions, AMP Bank offers a comprehensive suite of financial products and services.

2. History of AMP Bank Limited

AMP Bank Limited has a rich history that dates back to its establishment in 1849 as the Australian Mutual Provident Society. Initially, it operated as a life insurance company, but over the years, it expanded its operations to include banking services. In 2002, AMP Bank officially became a bank, regulated by the Australian Prudential Regulation Authority (APRA). Today, it stands as a leading financial institution with a strong presence in the Australian banking sector.

3. Products and Services Offered

3.1 Home Loans

AMP Bank provides a diverse range of home loan options to help individuals achieve their dream of homeownership. Whether it’s purchasing a new property, refinancing an existing loan, or investing in real estate, AMP Bank offers competitive interest rates, flexible repayment options, and expert guidance throughout the loan application process.

3.2 Savings Accounts

To encourage savings and help customers grow their wealth, AMP Bank offers a variety of savings accounts. These accounts come with attractive interest rates and features such as online banking, mobile app access, and convenient withdrawal options. Customers can choose from options like high-interest savings accounts, term deposits, and cash management accounts based on their financial goals and preferences.

3.3 Transaction Accounts

AMP Bank’s transaction accounts are designed to provide customers with convenient and secure everyday banking services. These accounts come with features such as debit cards, online and mobile banking access, BPAY payments, and ATM withdrawals. With flexible transaction limits and fee-free options, AMP Bank ensures that customers can manage their finances with ease.

3.4 Personal Loans

For individuals in need of extra funds for various purposes such as travel, education, or debt consolidation, AMP Bank offers competitive personal loan options. These loans are tailored to meet individual needs and come with flexible repayment terms, competitive interest rates, and fast approval processes.

3.5 Credit Cards

AMP Bank provides a range of credit card options that cater to different spending habits and preferences. Whether customers are looking for low-interest rates, rewards programs, or exclusive benefits, AMP Bank’s credit cards offer a variety of features to suit diverse financial needs.

3.6 Business Banking

AMP Bank understands the unique requirements of businesses and provides a comprehensive suite of banking solutions for businesses of all sizes. From business loans and overdraft facilities to merchant services and cash management solutions, AMP Bank’s business banking offerings help entrepreneurs manage their finances efficiently and support their growth.

4. Digital Banking Solutions

AMP Bank recognizes the importance of digital banking in today’s fast-paced world. It offers a range of digital solutions to enhance the banking experience for customers.

4.1 Online Banking

AMP Bank’s online banking platform allows customers to conveniently manage their accounts, make transactions, and access various banking services from anywhere at any time. The user-friendly interface and robust security measures ensure a seamless and secure online banking experience.

4.2 Mobile Banking

With the AMP Bank mobile banking app, customers can access their accounts on the go. The app provides features such as balance inquiries, fund transfers, bill payments, and transaction history. It also offers additional functionalities like fingerprint or facial recognition login for added security and convenience.

4.3 Financial Tools and Apps

AMP Bank offers a range of financial tools and apps to assist customers in managing their finances effectively. These tools include budgeting apps, savings calculators, mortgage calculators, and retirement planning tools. By leveraging these resources, customers can gain better control over their financial well-being.

5. AMP Bank’s Commitment to Customer Service

AMP Bank places a strong emphasis on providing exceptional customer service. It aims to build long-term relationships with its customers by offering personalized solutions and support. The bank’s dedicated customer service team ensures that queries and concerns are addressed promptly, and customers receive the assistance they need throughout their banking journey.

6. Community Engagement and Corporate Social Responsibility

AMP Bank is committed to making a positive impact on the communities it serves. Through various corporate social responsibility initiatives, the bank supports local organizations, charities, and community development projects. These efforts reflect AMP Bank’s commitment to being a responsible corporate citizen and contributing to the betterment of society.

7. Financial Stability and Industry Recognition

AMP Bank has established a strong reputation for financial stability and sound business practices. It is regulated by APRA, which ensures that the bank adheres to stringent financial standards and regulations. Over the years, AMP Bank has received industry recognition for its outstanding products, services, and customer satisfaction, further solidifying its position as a trusted financial institution.

Conclusion

In conclusion, AMP Bank Limited is a leading Australian financial institution that offers a wide range of banking products and services. From home loans and savings accounts to business banking solutions, AMP Bank caters to the diverse needs of individuals and businesses. With its commitment to customer service, digital banking solutions, and community engagement, AMP Bank continues to be a reliable and customer-centric banking partner for Australians.

Frequently Asked Questions (FAQs)

9.1 How can I open an account with AMP Bank?

Opening an account with AMP Bank is a straightforward process. You can visit their website or a local branch to start the application process. The bank will guide you through the necessary steps and documentation required to open an account.

9.2 What are the interest rates offered on home loans?

Interest rates on home loans offered by AMP Bank vary depending on factors such as the loan amount, type of loan, and current market conditions. It is advisable to contact AMP Bank directly or visit their website to get the most up-to-date information on interest rates.

9.3 Does AMP Bank offer business loans?

Yes, AMP Bank offers business loans to support the financial needs of businesses. These loans are designed to provide capital for various purposes, including business expansion, equipment purchases, and working capital requirements. You can reach out to AMP Bank’s business banking team for more information on their business loan offerings.

9.4 Can I access my AMP Bank accounts through mobile banking?

Yes, AMP Bank provides a mobile banking app that allows customers to access and manage their accounts conveniently from their mobile devices. The app offers features such as balance inquiries, fund transfers, bill payments, and transaction history.

9.5 How does AMP Bank support the local community?

AMP Bank is committed to supporting the local community through various corporate social responsibility initiatives. The bank collaborates with local organizations, charities, and community projects to make a positive impact. AMP Bank’s support includes financial contributions, employee volunteering programs, and partnerships aimed at addressing community needs.

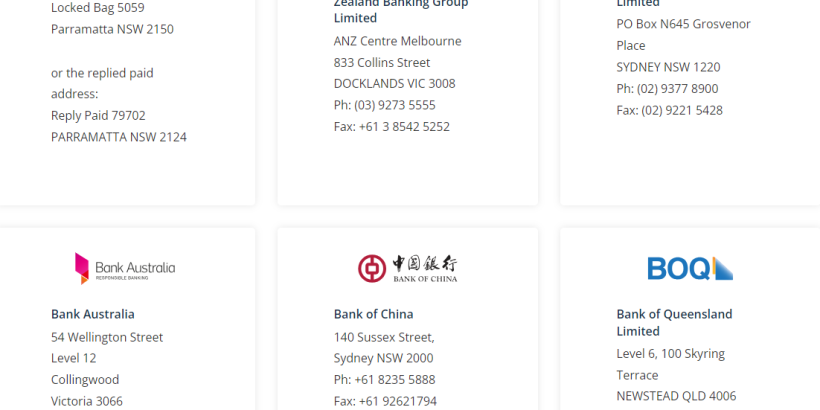

ANZ

Australia and New Zealand Banking Group Limited

ANZ Centre Melbourne

833 Collins Street

DOCKLANDS VIC 3008

Ph: (03) 9273 5555

Fax: +61 3 8542 5252

Australia and New Zealand Banking Group Limited: A Comprehensive Overview

Introduction

Australia and New Zealand Banking Group Limited, commonly known as ANZ, is one of the leading banking institutions in the Australasian region. With a rich history spanning over a century, ANZ has played a pivotal role in the economic development of both Australia and New Zealand. In this article, we will delve into the origins of ANZ, its growth, the services it offers, and its impact on the financial landscape of the region.

Table of Contents

The Founding of ANZ

Early Beginnings

Merger of Banks

ANZ’s Growth and Expansion

Diversification of Services

International Presence

Key Financial Services Provided by ANZ

Retail Banking

Corporate Banking

Wealth Management

Institutional Banking

ANZ’s Commitment to Sustainability

Environmental Initiatives

Social Responsibility

Technology and Innovation at ANZ

Digital Banking Solutions

Fintech Collaborations

ANZ’s Impact on the Australian and New Zealand Economies

Employment Opportunities

Support to Small Businesses

Challenges Faced by ANZ

Regulatory Environment

Competition in the Banking Sector

ANZ’s Response to the COVID-19 Pandemic

Financial Relief Measures

Community Support

Future Outlook and Strategic Initiatives

Focus on Digital Transformation

Expansion into Emerging Markets

Conclusion

The Founding of ANZ

Early Beginnings

ANZ traces its origins back to the 19th century when the Bank of Australasia was established in Sydney in 1835. Meanwhile, the Union Bank of Australia was founded in Melbourne in 1837. Both banks served the growing needs of the colonies and played crucial roles in facilitating trade and commerce.

Merger of Banks

In 1951, the Bank of Australasia and the Union Bank of Australia merged to form the Australia and New Zealand Bank Limited (ANZ Bank). This strategic union brought together the expertise and resources of both institutions, allowing ANZ to expand its services and create a stronger financial entity.

ANZ’s Growth and Expansion

Diversification of Services

Over the years, ANZ diversified its services to meet the changing needs of its customers. Apart from traditional banking products, ANZ started offering insurance, asset management, and brokerage services. This diversification positioned ANZ as a one-stop financial solution for individuals and businesses alike.

International Presence

ANZ’s growth extended beyond the shores of Australia and New Zealand. The bank ventured into international markets, establishing a significant presence in Asia, Europe, and the Americas. This expansion not only broadened ANZ’s customer base but also strengthened its global reputation.

Key Financial Services Provided by ANZ

Retail Banking

ANZ’s retail banking segment caters to individuals, providing a range of products such as savings accounts, credit cards, personal loans, and mortgages. The bank’s user-friendly digital platforms have made banking more accessible and convenient for its customers.

Corporate Banking

ANZ’s corporate banking division serves businesses of all sizes, providing them with customized financial solutions, including working capital financing, trade finance, and cash management services. Its expertise in international trade has made it a preferred partner for businesses engaged in global transactions.

Wealth Management

ANZ offers comprehensive wealth management services, including investment advisory, retirement planning, and portfolio management. The bank’s experienced wealth managers assist clients in achieving their financial goals and securing their future.

Institutional Banking

ANZ’s institutional banking caters to large organizations, government entities, and multinational corporations. It provides a range of corporate and investment banking services, including debt and equity financing, treasury solutions, and risk management.

ANZ’s Commitment to Sustainability

Environmental Initiatives

ANZ has been actively involved in sustainability efforts, recognizing its responsibility to address environmental challenges. The bank has adopted eco-friendly practices, reduced its carbon footprint, and invested in renewable energy projects.

Social Responsibility

ANZ takes pride in its social responsibility initiatives that support various community projects and charitable organizations. Through its foundation, ANZ actively contributes to education, health, and social welfare programs.

Technology and Innovation at ANZ

Digital Banking Solutions

ANZ has embraced technological advancements, introducing innovative digital banking solutions to enhance customer experience. From mobile banking apps to internet banking platforms, ANZ ensures seamless and secure financial transactions.

Fintech Collaborations

To stay at the forefront of the digital revolution, ANZ collaborates with fintech startups. These partnerships enable the bank to integrate cutting-edge technologies into its operations and provide customers with innovative financial services.

ANZ’s Impact on the Australian and New Zealand Economies

Employment Opportunities

As one of the largest employers in the region, ANZ generates thousands of jobs, contributing significantly to the local economies of Australia and New Zealand.

Support to Small Businesses

ANZ actively supports small businesses by providing them with access to finance, mentorship, and resources. The bank plays a vital role in nurturing entrepreneurship and fostering economic growth.

Challenges Faced by ANZ

Regulatory Environment

Like all financial institutions, ANZ operates in a complex regulatory environment. Staying compliant with ever-evolving regulations requires constant monitoring and adaptation.

Competition in the Banking Sector

The banking industry is highly competitive, with both domestic and international players vying for market share. ANZ continually strategizes to differentiate itself and maintain a competitive edge.

ANZ’s Response to the COVID-19 Pandemic

Financial Relief Measures

During the COVID-19 pandemic, ANZ introduced various financial relief measures to assist customers and businesses facing economic hardships. These measures included loan deferments, fee waivers, and flexible repayment options.

Community Support

ANZ actively participated in community support initiatives during the pandemic. The bank donated funds to healthcare organizations and collaborated with local authorities to provide aid to vulnerable communities.

Future Outlook and Strategic Initiatives

Focus on Digital Transformation

ANZ continues to prioritize digital transformation to enhance its services and operations. The bank aims to offer cutting-edge technological solutions that meet the evolving demands of its customers.

Expansion into Emerging Markets

ANZ explores opportunities to expand its presence in emerging markets, recognizing their growth potential. By entering these markets, ANZ can diversify its revenue streams and strengthen its global position.

Conclusion

As a prominent financial institution in Australia and New Zealand, ANZ has played a significant role in shaping the region’s economic landscape. From its early beginnings to its extensive international reach, ANZ has demonstrated a commitment to serving its customers and contributing to the community. With a focus on sustainability, innovation, and customer-centricity, ANZ continues to evolve and adapt to the dynamic financial landscape.

FAQs

Is ANZ a government-owned bank?

No, ANZ is not a government-owned bank. It is a publicly listed company with its shares traded on the stock exchange.

Does ANZ operate only in Australia and New Zealand?

No, ANZ has a global presence and operates in several countries across Asia, Europe, and the Americas.

How can I open an account with ANZ?

You can open an account with ANZ by visiting one of their branches or applying online through their official website.

Does ANZ offer mobile banking services?

Yes, ANZ provides mobile banking services through its user-friendly mobile app, allowing customers to manage their accounts on-the-go.

What is ANZ’s approach to sustainability?

ANZ is committed to sustainability through eco-friendly practices, reducing carbon emissions, and investing in renewable energy projects.

Are there any fees for using ANZ’s digital banking services?

ANZ offers many digital banking services with no additional fees, but some specific transactions or services may have associated charges. It is essential to check the bank’s fee schedule for complete details.

How does ANZ support the community through its foundation?

ANZ’s foundation supports various community projects focused on education, health, and social welfare. The foundation partners with non-profit organizations and community groups to address key social issues and make a positive impact.

What are ANZ’s initiatives to promote financial literacy?

ANZ actively promotes financial literacy through educational programs and resources. The bank organizes workshops and seminars to empower individuals and businesses with essential financial knowledge.

What security measures does ANZ have in place for its digital services?

ANZ takes data security seriously and implements robust encryption and multi-factor authentication to protect customer information during digital transactions. The bank continuously updates its security measures to stay ahead of potential threats.

How has ANZ contributed to environmental conservation?

ANZ actively participates in environmental conservation by supporting projects that focus on reducing carbon emissions, conserving biodiversity, and promoting sustainable practices in various sectors.

In conclusion, Australia and New Zealand Banking Group Limited (ANZ) holds a prominent position in the financial landscape of the Australasian region. With a history spanning over a century, ANZ has evolved into a comprehensive financial institution providing diverse services to individuals, businesses, and institutions. Its commitment to sustainability, innovation, and community support has made it a trusted and responsible banking partner.

abal banking

Arab Bank Australia Limited

PO Box N645 Grosvenor Place

SYDNEY NSW 1220

Ph: (02) 9377 8900

Fax: (02) 9221 5428

Bank Australia

54 Wellington Street

Level 12

Collingwood

Victoria 3066

Locked Bag 2035

Collingwood

Victoria, 3066

Bank of China

140 Sussex Street,

Sydney NSW 2000

Ph: +61 8235 5888

Fax: +61 92621794

BOQ

Bank of Queensland Limited

Level 6, 100 Skyring Terrace

NEWSTEAD QLD 4006

GPO Box 898

BRISBANE QLD 4001

Ph: 1300 55 72 72

Bank of Sydney

Bank of Sydney

62 Pitt St

Sydney NSW 2000

Ph: 13 95 00

Ph: +61 2 8262 9191

Bendigo and Adelaide Bank

Bendigo and Adelaide Bank Limited

The Bendigo Centre

Bendigo, Victoria 3550

PO Box 480

Bendigo Victoria 3552

Ph: 1300 361 911

Citi

Citigroup Pty Ltd

2 Park Street

SYDNEY NSW 2000

Ph: 13 24 84

Commonwealth Bank of Australia

Commonwealth Bank Place South

Level 1,

11 Harbour Street,

Sydney NSW 2000

Ph: 132 221.

HSBC

HSBC Bank Australia Limited

Level 36 Tower 1, International Towers Sydney

100 Barangaroo Avenue

Sydney NSW 2000

Ph: (02) 9006 5888

Fax: (02) 9006 544

ING

ING Bank (Australia) Limited

60 Margaret Street

SYDNEY NSW 2000

Ph: (02) 9028 4000

Fax: (02) 9028 4229

J.P. Morgan Australia and New Zealand

Sydney, Australia: +612 9003 8888

Melbourne, Australia: +613 9633 4000

Macquarie

Macquarie Bank Limited

No.1 Martin Place

SYDNEY NSW 2000

Ph: (02) 8232 3333

MUFG

MUFG Bank Limited

Level 26, 1 Macquarie Place

SYDNEY NSW 2000

Ph: (02) 9296 1111

MyState

MyState Bank

Level 2, 137 Harrington Street

Hobart TAS 7001

Ph: 138 001

National Australia Bank Limited

500 Bourke Street

MELBOURNE VIC 3000

Ph: (03) 9641 3500

Fax: (03) 9641 4916

Rabobank

Rabobank Australia Limited

Level 16

Darling Park Tower 3

201 Sussex Street

SYDNEY NSW 2000

Ph: (02) 8115 4000

Suncorp

Suncorp Bank

Level 28, 266 George Street

BRISBANE QLD 4000

Ph: (07) 3362 1222

Fax: (07) 3832 5139

Westpac

Westpac Banking Corporation

Westpac Place

275 Kent Street

SYDNEY NSW 2000

Ph: (02) 9293 9270