The future banking Services 2050

- Introduction to the Future of Banking Services

- Technological Advancements in Banking

- Artificial Intelligence (AI) in Banking

- Blockchain Technology and Cryptocurrencies

- Biometric Authentication

- Internet of Things (IoT) in Banking

- Personalized Banking Experience

- Virtual Financial Assistants

- Personalized Investment Advice

- Customized Financial Planning

- Enhanced Security Measures

- Advanced Fraud Detection Systems

- Biometric Identification for Transactions

- Secure Digital Identity Management

- Seamless Omni-Channel Banking

- Integrated Digital Platforms

- Wearable Banking Devices

- Voice and Gesture Recognition

- Impact of Big Data and Analytics

- Personalized Product Offerings

- Risk Assessment and Credit Scoring

- Enhanced Customer Insights

- Collaboration between Banks and Fintech Companies

- Open Banking and APIs

- Fintech Partnerships for Innovation

- Green and Sustainable Banking

- Environmental Impact of Banking Operations

- Sustainable Investment Options

- Renewable Energy Financing

- Changing Role of Physical Branches

- Digital Branch Transformation

- Hybrid Banking Experiences

- Ethical and Transparent Banking Practices

- Socially Responsible Investing

- Fair Lending and Financial Inclusion

- Transparent Fee Structures

- Future Challenges and Opportunities in Banking

- Regulatory Compliance in a Digital Era

- Cybersecurity Threats and Data Privacy

- Upskilling and Reskilling the Workforce

- Conclusion

Future banking Services 2050

The Future of Banking Services 2050

The banking industry has come a long way in the past few decades, and the future promises even more remarkable transformations. As technology continues to advance at an unprecedented pace, banking services are poised to undergo significant changes by the year 2050. In this article, we will explore the exciting developments and trends that will shape the future of banking and revolutionize the way we manage our finances.

1. Introduction to the Future of Banking Services

Banking services have evolved significantly over the years, from traditional brick-and-mortar branches to online banking and mobile apps. The future of banking services envisions a world where cutting-edge technology seamlessly integrates with financial transactions, ensuring convenience, security, and personalized experiences for customers.

2. Technological Advancements in Banking

Artificial Intelligence (AI) in Banking

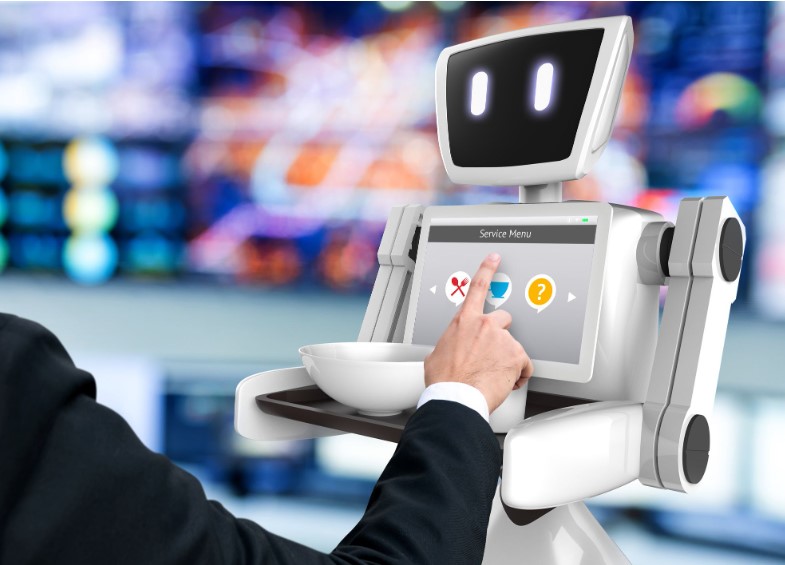

Artificial Intelligence (AI) is set to play a pivotal role in the future of banking. AI-powered chatbots and virtual assistants will enable customers to interact with banks through natural language processing, offering real-time support and personalized assistance.

Blockchain Technology and Cryptocurrencies

Blockchain technology, with its decentralized and secure nature, will transform the way banking transactions are conducted. Cryptocurrencies, powered by blockchain, may become a mainstream form of currency, providing faster and more cost-effective cross-border transactions.

Biometric Authentication

Biometric authentication methods, such as fingerprint and facial recognition, will replace traditional passwords and PINs. This advancement will enhance security and streamline the authentication process, ensuring a seamless banking experience.

Internet of Things (IoT) in Banking

The Internet of Things (IoT) will enable banks to connect with various devices, creating a network of interconnected financial services. IoT-powered devices, like smart homes and connected cars, will facilitate automated payments, insurance claims, and personalized financial insights.

3. Personalized Banking Experience

The future of banking will be centered around providing personalized experiences tailored to individual customers’ needs.

Virtual Financial Assistants

Virtual financial assistants will act as personal finance managers, offering insights into spending patterns, budgeting advice, and customized recommendations for savings and investments.

Personalized Investment Advice

Using sophisticated algorithms and machine learning, banks will provide personalized investment advice based on customers’ financial goals, risk appetite, and market trends. This will democratize access to wealth management services and empower individuals to make informed investment decisions.

Customized Financial Planning

Advanced data analytics will enable banks to analyze customers’ financial data comprehensively. They will offer customized financial plans, taking into account factors such as income, expenses, debts, and long-term goals, helping individuals achieve their financial aspirations.

4. Enhanced Security Measures

With the increasing prevalence of cyber threats, banks will adopt robust security measures to protect customer data and transactions.

Advanced Fraud Detection Systems

AI-powered fraud detection systems will constantly monitor banking transactions and identify potential fraudulent activities in real-time. This proactive approach will minimize the risk of financial losses and safeguard customer accounts.

Biometric Identification for Transactions

Biometric authentication methods, such as fingerprint or iris scans, will be used to authorize and verify transactions, significantly reducing the risk of unauthorized access.

Secure Digital Identity Management

Blockchain technology will be leveraged to establish secure digital identities, providing a tamper-proof and transparent record of customers’ identities. This will enhance the security and integrity of online banking activities.

5. Seamless Omni-Channel Banking

The future of banking will witness the convergence of multiple channels, offering customers a seamless and consistent banking experience across various touchpoints.

Integrated Digital Platforms

Banks will develop integrated digital platforms that combine online banking, mobile apps, social media engagement, and other digital touchpoints. Customers will have access to their financial information and services through a single unified interface.

Wearable Banking Devices

Wearable devices, such as smartwatches and fitness trackers, will evolve into multifunctional banking tools. Customers will be able to check their account balances, make payments, and receive real-time financial updates directly on their wearables.

Voice and Gesture Recognition

Voice and gesture recognition technologies will enable customers to perform banking tasks simply by speaking or gesturing. This intuitive and hands-free approach will revolutionize the way customers interact with their banks.

6. Impact of Big Data and Analytics

The vast amount of data generated in the digital age will be harnessed by banks to provide personalized services and enhance decision-making processes.

Personalized Product Offerings

Using big data analytics, banks will gain insights into customers’ preferences, behaviors, and needs. This will allow them to offer personalized product recommendations, tailored to each customer’s financial goals and lifestyle.

Risk Assessment and Credit Scoring

Advanced analytics algorithms will enable banks to assess creditworthiness accurately and provide fair and customized loan offers. This will expand access to credit and reduce the reliance on traditional credit scoring models.

Enhanced Customer Insights

Big data analytics will provide banks with deep customer insights, enabling them to understand customer behavior, identify trends, and improve their service offerings. This data-driven approach will foster customer loyalty and retention.

7. Collaboration between Banks and Fintech Companies

Banks will increasingly collaborate with fintech companies to drive innovation and provide enhanced services to their customers.

Open Banking and APIs

Open banking initiatives will promote data sharing between banks and third-party fintech providers. Application Programming Interfaces (APIs) will facilitate secure data exchange, enabling customers to access a wide range of financial products and services from different providers through a single interface.

Fintech Partnerships for Innovation

Banks will form strategic partnerships with fintech startups to leverage their expertise in areas such as payments, lending, and wealth management. This collaboration will spur innovation and accelerate the development of cutting-edge banking solutions.

8. Green and Sustainable Banking

In the future, banks will play a crucial role in promoting environmental sustainability and supporting green initiatives.

8. Green and Sustainable Banking

In the future, banks will play a crucial role in promoting environmental sustainability and supporting green initiatives.

###Environmental Impact of Banking Operations

Banks will adopt sustainable practices to minimize their carbon footprint and reduce environmental impact. This includes investing in renewable energy sources, implementing energy-efficient technologies, and adopting eco-friendly operational processes.

Sustainable Investment Options

Banks will offer a wide range of sustainable investment options, allowing customers to align their investments with their values and support environmentally conscious projects. This will contribute to the growth of the green economy and sustainable development.

Renewable Energy Financing

Banks will actively participate in financing renewable energy projects, such as solar and wind farms. They will provide funding and expertise to support the transition to clean and renewable energy sources, contributing to a more sustainable future.

9. Changing Role of Physical Branches

The advent of digital banking services will reshape the role of physical branches, focusing on delivering value-added services and personalized experiences.

Digital Branch Transformation

Physical branches will undergo digital transformation, becoming more technology-enabled and customer-centric. They will offer self-service kiosks, virtual reality-based consultations, and interactive displays, providing a seamless blend of digital and physical banking experiences.

Hybrid Banking Experiences

Physical branches will serve as hubs for personalized consultations, complex transactions, and financial advice. Customers will have the flexibility to choose between digital channels and in-person interactions based on their preferences and needs.

10. Ethical and Transparent Banking Practices

In the future, banks will prioritize ethical practices and transparency to build trust with their customers.

Socially Responsible Investing

Banks will offer socially responsible investment options that consider environmental, social, and governance (ESG) factors. This will enable customers to invest in companies that align with their values and have a positive impact on society.

Fair Lending and Financial Inclusion

Banks will continue to focus on fair lending practices, ensuring equal access to credit and financial services for all individuals, regardless of their background or socioeconomic status. They will work towards promoting financial inclusion and narrowing the wealth gap.

Transparent Fee Structures

Banks will adopt transparent fee structures, clearly communicating the costs associated with various banking services. This transparency will empower customers to make informed decisions and avoid hidden charges.

11. Future Challenges and Opportunities in Banking

The future of banking services also comes with its own set of challenges and opportunities.

Regulatory Compliance in a Digital Era

Banks will face the challenge of navigating complex regulatory frameworks in an increasingly digital environment. They will need to ensure compliance with data protection regulations, cybersecurity standards, and consumer protection laws while delivering innovative services.

Cybersecurity Threats and Data Privacy

As banking services become more digitized, the risk of cyber threats and data breaches increases. Banks will need to invest in robust cybersecurity measures, educate customers about online security best practices, and prioritize data privacy to protect sensitive information.

Upskilling and Reskilling the Workforce

Technological advancements will require banks to upskill and reskill their workforce to adapt to new roles and responsibilities. Training programs and continuous learning opportunities will be essential to equip employees with the necessary skills and competencies.

12. Conclusion

The future of banking services in 2050 holds immense promise and potential. Technological advancements, personalized experiences, enhanced security measures, and sustainable practices will revolutionize the way we interact with banks and manage our finances. As the industry continues to evolve, banks must embrace innovation, prioritize customer-centricity, and navigate the challenges and opportunities that lie ahead.

Future banking Services 2050

FAQs (Frequently Asked Questions)

Q1: Will physical bank branches become obsolete in the future? A: While the role of physical bank branches will change, they will not become obsolete. They will transform into technology-enabled hubs, providing personalized consultations and value-added services.

Q2: How will banks ensure the security of customer data in the future? A: Banks will adopt advanced security measures, including biometric authentication, AI-powered fraud detection systems, and secure digital identity management, to safeguard customer data and transactions.

Q3: What is open banking, and how will it benefit customers? A: Open banking is an initiative that promotes data sharing between banks and third-party fintech providers through APIs. It will enable customers to access a wider range of financial products and services from different providers, enhancing choice and convenience.

Q4: Will banks play a role in promoting sustainability and combating climate change? A: Yes, banks will play a crucial role in promoting sustainability. They will invest in renewable energy projects, offer sustainable investment options, and adopt eco-friendly practices to reduce their environmental impact.

Q5: How will advancements in AI impact banking services? A: AI will revolutionize banking services by enabling personalized experiences, virtual financial assistants, and enhanced fraud detection. It will streamline processes, improve efficiency, and provide customers with tailored financial solutions.