MUFG Bank in Japan

Company Profile: Company Name MUFG Bank, Ltd.

President & CEO: Junichi Hanzawa

Head Office: 2-7-1, Marunouchi, Chiyoda-ku, Tokyo, Japan

Capital Stock 1,711,958 million yen

Stock Holder Mitsubishi UFJ Financial Group, Inc.

Mitsubishi UFJ Financial Group, Inc.

Date of Establishment: August 15, 1919

Number of Employees :32,786 (as of March 31, 2023)

Network Domestic Branches : 421

Overseas Branches: 105 (as of March 31, 2023)

The Origins of Our Bank

MUFG Bank today descends from a number of illustrious predecessor banks, dating as far back as the seventeenth century, but gaining momentum after the Meiji Restoration of 1868 and accelerating rapidly in the twentieth century. Our modern history began with a revolution. When the Meiji Restoration ended the Tokugawa shogunate, the shogunate’s business interests were disbanded and made available to aspiring entrepreneurs.

The Sanwa Bank, Ltd.

1656 : Shinroku Konoike, founder of the Konoike exhange bureau (forerunner of Sanwa Bank)

The Konoike exchange bureau (opened in 1656)

1656

The origins of Sanwa Bank go back to the early Tokugawa Period and the Konoike Money Exchange. The Konoike family, who were descended from samurai, began in sake-brewing and the shipping business in 1656 and moved into financial lending, primarily to the powerful land-owning daimyo class in the Osaka region. In 1670, the money exchange was among the Big Ten organizations chartered by the shogunate to provide financial services to the Japanese government.

1877

The Konoike Bank remained a local institution until 1877, not long after the Meiji Restoration (1868), when it was awarded a national banking charter.

1870

In 1870 a former samurai, Yataro Iwasaki, set up his own company, Tsukumo Shokai (renamed Mitsubishi Shokai in 1873), which was largely involved in shipping. Mitsubishi supplied transport ships to the Japanese government that helped defeat the Satsuma Rebellion of 1877, the most serious challenge to the new Meiji regime — thus intertwining the company with the rise of the modern Japanese state.

1874

It is said that the founder of Mitsubishi Shokai, Yataro Iwasaki, hung this Okame mask in the Tokyo head office around 1874. Okame is a female character in Japanese traditional theatre who brings happiness and good fortune.

1880

In 1880, Yataro established the Mitsubishi Kawase-ten (Exchange Store), a financial exchange house that also engaged in the warehousing business. In 1885, Mitsubishi took over the management of the 119th National Bank and formally entered the financial services industry, adopting the name Mitsubishi Bank in 1919.

1920

Mitsubishi Bank prospered during the tumultuous industrialization of the early twentieth century and opened a number of international offices, including London and New York in 1920, but its scope and organization shrank in the chaos after World War Two.

After the San Francisco Peace Treaty was signed, the bank gradually regained strength, reopening its offices in New York and London and establishing itself as a powerful trade coordination partner increasingly involved in corporate finance.

During the 1960s, the bank financed raw-material purchases, helped to build factories that turned out finished products, and promoted the distribution of the products worldwide, becoming an integral contributor to Japan’s export-led growth. During the 1970s, the bank opened several more international offices, including a subsidiary, Mitsubishi Bank of California, in 1972.

1880

The Yokohama Specie Bank opened for business in Japan and New York in 1880 before setting up another office in London in 1881, securing an international foothold that has become the basis for MUFG Bank’s current global presence. The bank was named after the specie, a silver coin used as an international currency for settling payments among traders.

The Yokohama Specie Bank actively participated in currency exchange and trade financing businesses in Asia. Already, by the second decade of the twentieth century, it had established a network of representative offices in almost all the major trading centers in the Pacific region and the world’s financial capitals.

Products & Services

=================

Corporate & Investment Banking

Syndicated Loan

Cross Border Syndicated Loan

Samurai Loan

Project Finance

ECA Finance

Acquisition Finance (LBO / MBO / Corporate M&A)

Real Estate Finance

Ship Finance

Green Climate Fund

Securitization

Account Receivables Purchases Scheme (“ARPS”)

Supply Chain Finance

Global Markets

Research

Personal banking services for residents of Japan

Transaction Banking

Cash Management

Trade Finance

ISO 20022 Adoption and Migration for Cross-Border Payments

Confirmation duty under Foreign Exchange and Foreign Trade Act

Transaction Services for Financial Institutions

JPY Cash Clearing

JPY Custody

Global Markets

The Global Markets Unit (GMU) has three main business pillars; (1) Sales & Trading, (2) Asset and Liability Management, and (3) Strategic Investment.

(1) Sales & Trading

Sales: Providing market products for clients

Trading: Intermediating between clients and markets to provide competitive price through appropriate risk management

(2) Asset and Liability Management (ALM)

ALM: Asset and Liability Management

Managing interest and liquidity risks residing in the bank’s balance sheet

Investing in sovereign bonds such as the JGB and U.S. Treasury

(3) Strategic Investment

Enhancing profitability and diversifying portfolios by investing in financial products such as corporate bonds and funds

Back Office

Carrying out operations and settlements supporting front offices, Sales & Trading, ALM, and Strategic Investment

Monitoring and checking the front offices to ensure the bank’s integrity

Personal banking services for residents of Japan

Clients who have a personal bank account

The following procedure and transaction are available on internet banking with machine translation .

Changing address/telephone number

Changing cash card PIN

Applying/activating for one time password card

Making fund transfer

Clients who want to open a personal bank account

In the process of opening new bank account, we will confirm with you the purpose of using the account.

Application form to open new bank account should be filled in at each branch office.

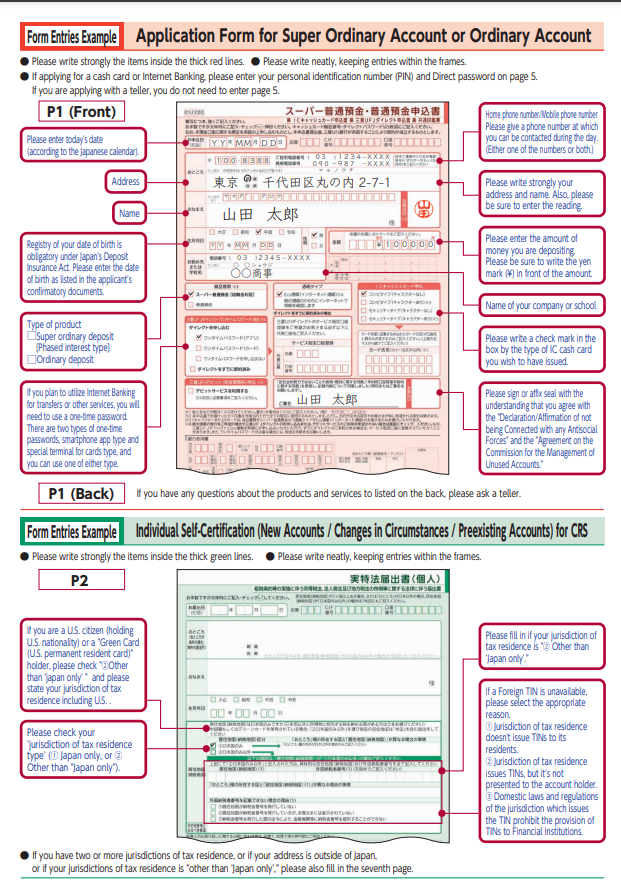

Please refer to the following links for completed samples.

Question: What are the documents required for account opening?

Ans: Voter ID. Utility bill (electricity, gas, water, telephone) Passport. Driving license.

Clients wishing to open a personal bank account

Pre-visit requests

Please prepare the below and visit the branch in person.

Customers who are working in Japan (Residents)

– Residence (zairyu) card (*1) (we will check the period of residency in Japan, residency status, etc.)

– Personal seal (*2)

– Documents to confirm your Individual Number (My Number) (*3)

– Documentation verifying your working status in Japan

Ex.: Your health insurance card with the name of the company where you work,

your statement of withholding tax with your company’s seal, your employment contract, etc.

Note: In some cases, we may confirm your employment with your employer

Customers who have resided in Japan for longer than six months (Residents)

– Residence (zairyu) card (*1) (we will check the period of residency in Japan, residency status, etc.)

– Personal seal (*2)

– Documents to confirm your Individual Number (My Number) (*3)

– Documentation verifying that you have resided in Japan for longer than six months

Ex.: Your residence (zairyu) card with a date of permission to reside in Japan of six months or more prior (if you have renewed your residence (zairyu) card, you may also use your previous residence (zairyu) card), your passport with your most recent visa to enter Japan showing an entry date of six months or more prior, your certificate of residence (juminhyo) with a date of becoming a resident of six months or more prior, etc.

Customers for whom (1) and (2) above do not apply (Non-residents)

– Residence (zairyu) card (*1) (we will check the period of residency in Japan, residency status, etc.)

– Personal seal (*2)

– Documents to confirm your Individual Number (My Number) (*3)

(*1) As you may generally apply to renew your residence status three months before the expiration of your period of residence, in the following case in which you have four months or less remaining in your period of residence, please visit the branch after renewing your residence status.

(*2) Rubber stamps, etc. cannot be used.

(*3) Documents to confirm your Individual Number (one of the following: Individual Number card, notification card, transcript of resident register or Certificate of Items Stated in Resident Register (showing Individual Number)

* The above documents (originals) must be within the expiry date, or have been issued in the past six months.