Difference Between Letter of Credit and Bank Guarantee

A Letter of Credit (LC) and a Bank Guarantee are both financial instruments used in international trade and business transactions to mitigate risks, but they serve different purposes and function differently.

1. Purpose

- Letter of Credit (LC):

- An LC is primarily used to ensure that a seller (exporter) receives payment for goods or services provided. It guarantees that the seller will be paid by the buyer’s bank, provided the seller meets all the terms and conditions specified in the LC.

- It is a payment mechanism that facilitates trade by assuring the seller that they will receive payment as long as they deliver according to the contract.

- Bank Guarantee:

- A Bank Guarantee, on the other hand, is a promise by a bank that the liabilities or obligations of a debtor will be met. In case the debtor fails to fulfill their contractual obligations, the bank will cover the losses incurred by the beneficiary up to the guaranteed amount.

- It is more of a safety net for the beneficiary, ensuring that they will be compensated if the other party fails to meet their obligations.

2. Parties Involved

- Letter of Credit (LC):

- Buyer (Applicant): The party requesting the LC.

- Seller (Beneficiary): The party in whose favor the LC is issued.

- Issuing Bank: The buyer’s bank, which issues the LC.

- Advising Bank: The seller’s bank, which advises the LC and may also confirm it.

- Bank Guarantee:

- Applicant: The party that requests the bank guarantee, typically the buyer or debtor.

- Beneficiary: The party that will receive the payment if the applicant fails to fulfill their obligations.

- Guarantor Bank: The bank that issues the guarantee.

3. Risk Exposure

- Letter of Credit (LC):

- The risk primarily lies with the bank issuing the LC. The bank assumes the risk of paying the seller once the terms of the LC are met, regardless of whether the buyer has sufficient funds.

- Bank Guarantee:

- The risk is borne by the bank only if the applicant defaults on their obligations. The bank’s liability is secondary, meaning it is only triggered if the applicant fails to pay.

4. Functionality

- Letter of Credit (LC):

- Works as a payment tool. The seller receives payment after presenting documents that comply with the terms of the LC (such as shipping documents, invoices, etc.).

- The bank pays the seller based on the documents, not the actual goods or services.

- Bank Guarantee:

- Acts as a security mechanism. The bank steps in to pay the beneficiary if the applicant defaults. It does not involve the actual transfer of money unless the guarantee is called upon.

5. Usage

- Letter of Credit (LC):

- Commonly used in international trade to mitigate the risk of non-payment by the buyer.

- Bank Guarantee:

- Used in various situations, including project contracts, loan agreements, and lease agreements, to provide assurance that obligations will be met.

6. Type of Obligation

- Letter of Credit (LC):

- Involves a primary obligation. The bank is directly responsible for payment once the seller meets the terms.

- Bank Guarantee:

- Involves a secondary obligation. The bank is only liable if the primary party (applicant) defaults.

7. Documentary Requirements

- Letter of Credit (LC):

- Requires the submission of specific documents (e.g., bill of lading, insurance documents, certificates of origin) that comply with the terms of the LC for payment to be made.

- Bank Guarantee:

- Generally does not require any documents to be submitted by the beneficiary. The guarantee is invoked by simply providing evidence of the applicant’s default.

8. Financial Impact

- Letter of Credit (LC):

- The bank may require collateral or funds from the buyer to issue an LC, which can tie up the buyer’s capital.

- Bank Guarantee:

- May require a certain amount of funds or collateral from the applicant, but it does not directly impact cash flow unless the guarantee is invoked.

Both Letters of Credit and Bank Guarantees are essential tools in mitigating risks in commercial transactions. An LC is mainly used to ensure payment in trade, while a Bank Guarantee provides a safety net against default in various contractual obligations. Understanding the differences between them helps in choosing the appropriate instrument for a given situation.

How is LC issued?

The process of issuing a Letter of Credit (LC) involves several steps and multiple parties, primarily the buyer (applicant), the seller (beneficiary), and the banks involved (issuing and advising banks). Here’s a step-by-step overview of how an LC is issued:

1. Agreement Between Buyer and Seller

- Contractual Agreement: The buyer and seller first enter into a sales contract that stipulates the terms of the sale, including the need for an LC as a payment method. This agreement outlines the goods or services to be provided, the payment amount, delivery terms, and other conditions.

- LC Terms: The seller specifies the LC terms, such as the type of LC, payment terms, required documents, and deadlines.

2. Application for the LC

- Buyer’s Request: The buyer (applicant) approaches their bank (the issuing bank) to request the issuance of an LC. The buyer provides the bank with details of the transaction, including the agreed terms with the seller.

- Application Form: The buyer fills out an LC application form provided by the issuing bank. This form includes details such as the amount, expiry date, the beneficiary’s name and address, and the documents required for payment.

3. Issuing Bank’s Review and Approval

- Credit Assessment: The issuing bank assesses the creditworthiness of the buyer and the details of the transaction. The bank may require collateral or a deposit from the buyer, depending on the buyer’s credit standing.

- LC Issuance: Upon approval, the issuing bank prepares the LC in accordance with the buyer’s application and issues it. The LC is a formal document that commits the bank to pay the seller once all specified conditions are met.

4. LC Transmission

- Advising Bank: The issuing bank sends the LC to the advising bank, usually located in the seller’s country. The advising bank acts as an intermediary, verifying the authenticity of the LC.

- Notification to Seller: The advising bank notifies the seller (beneficiary) that the LC has been issued in their favor and provides them with the details.

5. Seller’s Review

- LC Acceptance: The seller reviews the LC to ensure it aligns with the terms of the sales contract. If the LC terms are acceptable, the seller proceeds with the shipment of goods or provision of services. If there are discrepancies, the seller may request amendments.

6. Shipment of Goods/Provision of Services

- Shipment: The seller ships the goods or provides the services as per the agreement and the terms of the LC.

- Document Preparation: The seller prepares the required documents stipulated in the LC (e.g., bill of lading, commercial invoice, insurance documents, certificates of origin).

7. Presentation of Documents

- Submission to Advising Bank: The seller submits the required documents to the advising bank within the specified timeframe. The advising bank checks the documents for compliance with the LC terms.

- Document Transmission: If the documents are in order, the advising bank forwards them to the issuing bank for payment.

8. Payment

- Issuing Bank’s Review: The issuing bank reviews the documents received from the advising bank to ensure they comply with the LC’s terms and conditions.

- Payment to Seller: If the documents are in compliance, the issuing bank makes the payment to the seller either directly or through the advising bank, depending on the terms of the LC.

- Reimbursement: The issuing bank then seeks reimbursement from the buyer, either from the buyer’s account or through any collateral held.

9. Release of Documents

- Documents to Buyer: The issuing bank releases the documents to the buyer once payment is made or upon other agreed terms. The buyer uses these documents to take possession of the goods.

10. Completion of Transaction

- Final Settlement: The transaction is completed once the buyer receives the goods and the seller receives payment. Any remaining balances or claims are settled as per the agreement.

Key Considerations:

- Types of LCs: There are different types of LCs (e.g., revocable, irrevocable, confirmed, unconfirmed), each with specific characteristics that may affect the issuance process.

- Amendments: If the buyer or seller needs to make changes to the LC terms after issuance, they can request amendments through their respective banks.

- Discrepancies: If the issuing bank finds discrepancies in the documents, payment may be delayed or denied until the issues are resolved.

This process ensures that both the buyer and seller are protected in the transaction, with the bank serving as an intermediary to facilitate payment.

LC vs BG costs?

The costs associated with a Letter of Credit (LC) and a Bank Guarantee (BG) can vary depending on several factors, including the financial institution, the complexity of the transaction, the amount involved, and the duration of the instrument. Below is a comparison of the typical costs for each:

1. Issuance Fees

- Letter of Credit (LC):

- Issuance Fee: Charged by the issuing bank for creating the LC. This fee is often a percentage of the LC amount (usually between 0.1% to 1%), but it can also be a flat fee.

- Advising Fee: Charged by the advising bank for advising the LC to the beneficiary. This fee is usually lower and may also be a percentage or a fixed amount.

- Bank Guarantee (BG):

- Issuance Fee: Similar to an LC, the bank charges a fee for issuing the BG. This fee is typically a percentage of the guaranteed amount (ranging from 0.5% to 2% annually, depending on the risk and duration).

- Commission: Some banks may also charge an annual or quarterly commission based on the value of the guarantee.

2. Amendment Fees

- Letter of Credit (LC):

- Amendment Fee: Charged if the terms of the LC need to be changed after issuance. The fee varies based on the nature of the amendment but is generally a flat fee or a percentage of the LC amount.

- Bank Guarantee (BG):

- Amendment Fee: Also applies if the terms of the BG need to be modified. Similar to an LC, this is typically a flat fee or a percentage.

3. Document Examination Fees

- Letter of Credit (LC):

- Document Examination Fee: Charged by the issuing or confirming bank for reviewing the documents presented by the seller. This fee can be a flat rate or a percentage of the LC amount.

- Bank Guarantee (BG):

- No Equivalent Fee: Since a BG is not dependent on the submission of documents for payment, there is no document examination fee.

4. Confirmation Fees

- Letter of Credit (LC):

- Confirmation Fee: If the LC is confirmed by another bank, there is an additional fee. This fee compensates the confirming bank for the added risk and is usually a percentage of the LC amount.

- Bank Guarantee (BG):

- No Equivalent Fee: Typically, a BG does not require confirmation by another bank, so this fee does not apply.

5. Usage Fees

- Letter of Credit (LC):

- Usage Fee: Some banks may charge a fee each time the LC is drawn upon or when documents are presented. This is more common in revolving LCs.

- Bank Guarantee (BG):

- Usage Fee: If the guarantee is invoked (i.e., the beneficiary demands payment), there might be a fee associated with processing the claim, but this is not common.

6. Collateral Costs

- Letter of Credit (LC):

- Collateral Requirement: Depending on the buyer’s creditworthiness, the issuing bank might require collateral, which could tie up capital or require a margin deposit.

- Bank Guarantee (BG):

- Collateral Requirement: Banks often require collateral for issuing a BG, which could be in the form of cash, securities, or other assets. The value and form of collateral can impact the cost.

7. Interest Costs

- Letter of Credit (LC):

- Interest on Advances: If the buyer does not have sufficient funds to cover the LC, the bank may advance funds and charge interest. This can add to the overall cost of the LC.

- Bank Guarantee (BG):

- Interest Costs: While BGs themselves do not incur interest, if the applicant defaults and the bank pays the beneficiary, the bank may recover the amount from the applicant with interest.

Summary:

- LC Costs: Generally include issuance fees, advising fees, amendment fees, document examination fees, and potential confirmation fees.

- BG Costs: Typically include issuance fees, commission, amendment fees, and potential collateral costs.

Overall, LCs tend to involve more ongoing costs related to document handling and confirmations, while BGs may have higher initial fees and collateral requirements, especially if the guarantee covers a significant amount or duration.

How long is LC/BG valid?

The validity of a Letter of Credit (LC) and a Bank Guarantee (BG) depends on the specific terms outlined in each instrument, as well as the nature of the transaction or contract they are associated with. Here’s an overview of the typical validity periods:

1. Letter of Credit (LC) Validity

- Typical Duration:

- An LC is usually valid for a period ranging from 30 days to 180 days. However, this can vary significantly depending on the nature of the transaction. For example, LCs related to construction projects or large equipment purchases may be valid for longer periods, potentially up to a year or more.

- Expiration Date:

- The LC will include a specific expiration date, which is the last date on which the beneficiary can present the required documents for payment. If the beneficiary does not present compliant documents by this date, the LC expires, and the bank’s obligation to pay ends.

- Latest Shipment Date:

- In addition to the overall validity period, an LC typically specifies a latest shipment date, which is the last date the goods can be shipped. This ensures that the documents presented are for goods shipped within the agreed timeframe.

- Extension:

- The validity of an LC can sometimes be extended through an amendment, which must be agreed upon by all parties involved (buyer, seller, and the banks).

2. Bank Guarantee (BG) Validity

- Typical Duration:

- A BG is usually valid for the duration of the contract or obligation it is guaranteeing. This can range from a few months to several years. For instance, performance guarantees might last until the completion of a project, while payment guarantees might be valid until the final payment is made.

- Expiry Date:

- A BG includes an explicit expiry date or a condition that defines when the guarantee will expire. This can be a fixed calendar date or a period after the occurrence of a specific event (e.g., six months after project completion).

- Claim Period:

- Some BGs include a claim period, which is an additional period after the expiry date during which the beneficiary can make a claim. This period provides extra time for the beneficiary to assess whether the applicant has fulfilled their obligations.

- Automatic Renewal (Evergreen Clause):

- Some BGs have an “evergreen” clause, which means the guarantee automatically renews unless the bank provides notice of non-renewal within a specified time frame before the expiry date.

- Cancellation:

- BGs can sometimes be canceled before their expiry date if the beneficiary agrees that the obligations have been met, or if the underlying contract is terminated.

Summary:

- LC Validity: Typically 30 to 180 days, depending on the transaction, with a specific expiration date for document presentation.

- BG Validity: Can range from a few months to several years, aligned with the duration of the contract or obligation, with an explicit expiry date and possibly a claim period.

The exact validity period for both an LC and a BG is negotiable and should be clearly stated in the instrument’s terms.

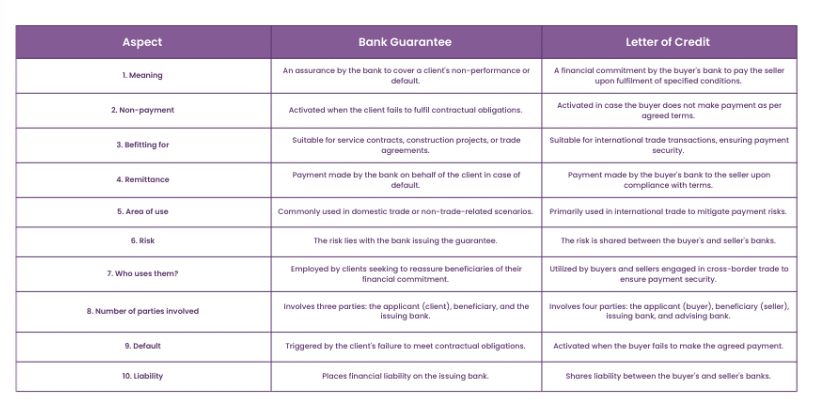

Key Differences Between Letter of Credit and Bank Guarantee

The main differences between a letter of credit (LC) and a bank guarantee (BG) are:

- Parties Involved:

- Letter of Credit: Involves 5 or more parties – buyer, seller, issuing bank, advising bank, negotiating bank, and confirming bank.

- Bank Guarantee: Involves only 3 parties – buyer, seller, and the bank.

- Payment Mechanism:

- Letter of Credit: The bank makes the payment when the LC becomes due, provided the seller presents the required document.

- Bank Guarantee: The bank pays the beneficiary only when the buyer fails to fulfill their contractual obligations.

- Risk Profile:

- Letter of Credit: Carries higher risk for the bank but lower risk for the seller.

- Bank Guarantee: Carries higher risk for the seller but lower risk for the bank.

- Usage:

- Letter of Credit: Commonly used in international trade transaction.

- Bank Guarantee: Frequently used in real estate agreements, construction projects, and other domestic transactions.

- Cost:

- Bank Guarantees are generally more expensive than letters of credit.

- Irrevocability:

- Letter of Credit: Can be irrevocable, meaning it cannot be changed or canceled without the consent of all parties.

- Bank Guarantee: Can be revoked by the bank at any time.

Similarities

Despite the differences, both LCs and BGs serve similar purposes:

- Provide financial security and reduce risk for the parties involved in a transaction

- Demonstrate the creditworthiness of the buyer or applicant

- Facilitate trade and business transactions that would otherwise be risky

- In summary, while both letters of credit and bank guarantees are financial instruments used to facilitate transactions and mitigate risk, they differ in terms of the parties involved, payment mechanisms, risk profiles, usage, and cost. Understanding these differences is crucial for businesses to choose the appropriate instrument based on their specific needs and the nature of their transactions.

When should I use a letter of credit over a bank guarantee?

When deciding whether to use a letter of credit (LC) or a bank guarantee (BG), consider the following factors based on the nature of your transaction and the associated risks:

When to Use a Letter of Credit

- International Trade: LCs are particularly beneficial in international transactions where the buyer and seller may not have an established relationship. They provide assurance to the seller that payment will be made upon meeting the specified conditions, such as delivering goods and providing necessary documentation.

- Payment Assurance: If you are a seller wanting to ensure that you will receive payment for goods shipped, an LC is ideal. It guarantees that the bank will pay you as long as you comply with the terms outlined in the L.

- Reducing Payment Risk: If you are concerned about the buyer’s ability to pay, using an LC can mitigate this risk. The bank assumes the payment responsibility, thus protecting the seller from potential default by the buyer.

- Complex Transactions: In cases where transactions involve multiple parties (e.g., advising and negotiating banks), an LC is preferable as it can handle the complexities better than a BG.

When to Use a Bank Guarantee

- Contractual Obligations: BGs are more suitable when you need to assure a party that you will fulfill a contractual obligation. They act as a safety net, ensuring that if you fail to meet your commitments, the bank will cover the losses.

- Performance Security: If you are involved in projects (like construction or real estate) where performance is critical, a BG can provide assurance to the other party that you will complete the project as agreed. It protects against risks associated with non-performance.

- Domestic Transactions: BGs are often used in domestic contracts and agreements, where the parties may have a closer relationship, and the risks are more about performance than payment.

- Bidding Processes: In tendering situations, a BG can serve as a bid bond, demonstrating your commitment and financial capability to undertake the project if awarded.

Key Benefits of Using a Letter of Credit in International Trade

- Payment Guarantee: A letter of credit provides the seller with a guarantee of payment from the buyer’s bank, as long as the seller meets the specified conditions outlined in the LC.

- Reduced Risk: LCs help mitigate risks associated with international trade, such as non-payment or fraud, by creating a contractual relationship between the banks rather than directly between the buyer and seller.

- Flexibility in Payment Terms: LCs allow importers to negotiate favorable payment terms aligned with their cash flow requirement

- Improved Cash Flow: LCs provide greater security compared to other payment methods, allowing exporters to plan their finances more confidently.

- Reaching New Markets: LCs give trade parties the ability to find and transact with new or unknown customers residing oversea.

- Timely Shipments: Exporters can apply for pre-shipment financing against an LC to receive an advance payment before shipping goods to buyers.

- Credibility: Using LCs signals credibility and trustworthiness among global counterparts, as they are widely recognized and accepted across border.

- Delivery Assurance: Importers using an LC ensure they will receive goods as agreed upon before making any payment.

In summary, letters of credit offer significant advantages for both buyers and sellers in international trade, including payment assurance, risk reduction, flexibility in terms, improved cash flow, and access to new markets. However, it’s important to be aware of the potential disadvantages, such as high costs, time-consuming processes, and fraud risks, before using an LC.