What is IRC and ERC?

IRC and ERC: Required papers / documents to obtain Import Registration Certificate (IRC)

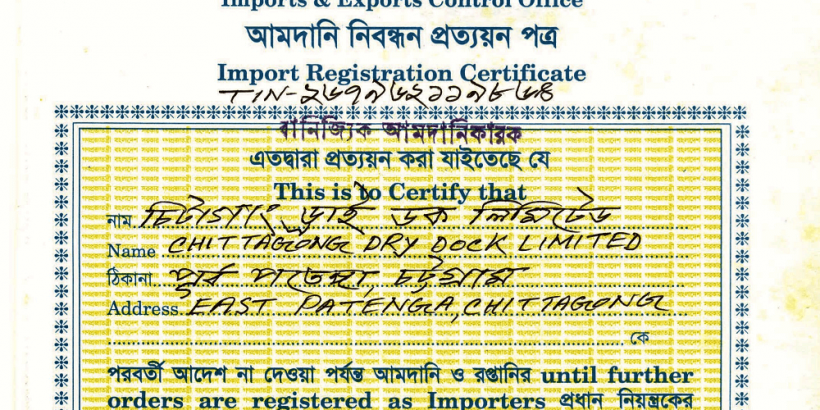

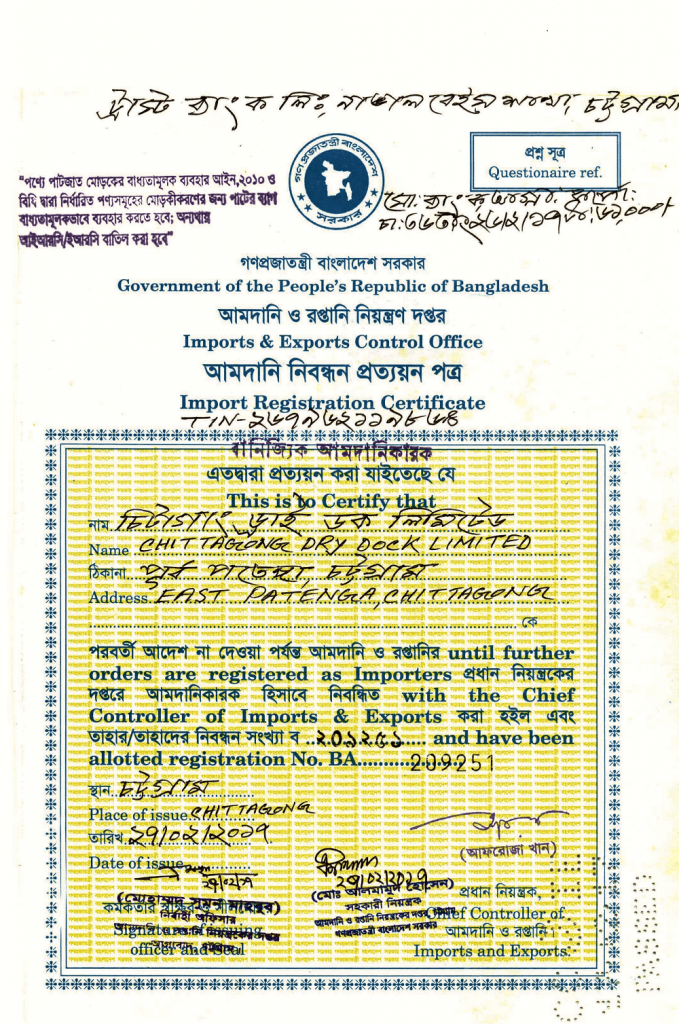

Import Registration Certificate (IRC) and Export Registration Certificate (ERC) are issued by the office of chief controller of Import and Exports (CCI & E) of the government. Intending Imports and Exporters are to submit applications to CCI & E for registration along with required papers / documents.

An Import Registration Certificate (IRC) is an official document issued by the relevant government authority in some countries that allows a business or individual to import goods into the country. It is typically a requirement for businesses involved in international trade and is meant to regulate imports to ensure compliance with local laws, taxes, and trade regulations.

Here are some key aspects related to the IRC:

- Purpose: The IRC helps authorities monitor and control the importation of goods, ensuring that they meet safety standards, are taxed appropriately, and comply with national trade policies.

- Requirements: To obtain an IRC, businesses usually need to:

- Register with the appropriate trade or customs authority.

- Provide documentation such as business registration, tax identification, and other relevant business information.

- Comply with specific import guidelines set by the country’s government.

- Validity: The IRC may be valid for a certain period (usually one year) and needs to be renewed after expiration.

- Process:

- Application forms are typically submitted to the customs or trade regulatory authority.

- Required documents are reviewed and processed.

- Once approved, the certificate is issued, allowing the applicant to proceed with importing goods.

- Importance: Without an IRC, businesses may face difficulties in clearing customs or could be subject to fines and penalties.

Required papers / documents to obtain IRC

a. IRC Application form dully fill-up

b. Trade license

c. Nationality Certificate

d. Income Tax Certificate along with TIN

e. Bank Certificate

f. Membership Certificate from Trade Association

g. Certificate of Incorporation, Article and Memorandum of Association (In case of Limited company) , Registered Partnership Deed (In case of Partnership firm)

h. Any other documents as per current Import Policy Order.

MCQ: Export Registration Certificate (ERC)

Question 1: What is the main purpose of an Export Registration Certificate (ERC)?

A) To register the exporter with the customs authorities

B) To ensure the quality of exported goods

C) To track the financial records of exporters

D) To determine the tax liability of exported goods

Answer: A) To register the exporter with the customs authorities

Explanation: The Export Registration Certificate (ERC) is primarily used to register an exporter with the appropriate authorities, such as the customs or trade ministry, and allows them to engage in exporting goods legally. This ensures compliance with national and international trade regulations.

Question 2: Who typically needs to obtain an Export Registration Certificate (ERC)?

A) Only companies engaged in agricultural exports

B) Only businesses that import and export goods

C) Any entity intending to export goods from the country

D) Only individuals exporting for personal use

Answer: C) Any entity intending to export goods from the country

Explanation: The Export Registration Certificate (ERC) is required for any business, organization, or individual wishing to export goods. It ensures that exporters are recognized by the authorities and comply with export laws and regulations.

Question 3: Which of the following documents is usually required when applying for an Export Registration Certificate (ERC)?

A) Proof of payment of customs duties

B) Bank statement showing export-related income

C) Taxpayer Identification Number (TIN)

D) International trade agreement

Answer: C) Taxpayer Identification Number (TIN)

Explanation: One of the primary documents required to apply for an Export Registration Certificate (ERC) is the Taxpayer Identification Number (TIN). This ensures the applicant is registered with the tax authorities and complies with tax obligations. Additional documentation, such as business registration details, may also be needed.

Question 4: What is the validity period of an Export Registration Certificate (ERC)?

A) 1 year

B) 3 years

C) 5 years

D) It does not have an expiration date

Answer: C) 5 years

Explanation: The Export Registration Certificate (ERC) is typically valid for a period of 5 years, after which it needs to be renewed. This ensures that exporters remain compliant with the latest trade regulations and requirements.

Question 5: Can an Export Registration Certificate (ERC) be transferred to another business entity?

A) Yes, it can be transferred with prior approval from authorities

B) No, it is non-transferable

C) Yes, but only to a business within the same sector

D) Yes, if the new business operates in a different region

Answer: B) No, it is non-transferable

Explanation: The Export Registration Certificate (ERC) is specific to the business entity that holds it. If a business changes ownership or structure, the new owner or entity must apply for a new ERC. It is non-transferable between different entities.

Question 6: Which government body is typically responsible for issuing the Export Registration Certificate (ERC)?

A) Ministry of Commerce or Trade

B) Customs department

C) Ministry of Finance

D) Export Development Agency

Answer: A) Ministry of Commerce or Trade

Explanation: The Export Registration Certificate (ERC) is generally issued by the Ministry of Commerce or the Ministry of Trade in many countries. These bodies are responsible for regulating trade and ensuring that exporters comply with legal and regulatory requirements.

Question 7: What would happen if a business exports goods without an Export Registration Certificate (ERC)?

A) The goods will be automatically exempt from customs inspection

B) The business may face fines, penalties, or confiscation of goods

C) The export process will be delayed due to customs inspections

D) The exporter will be required to pay higher duties on the goods

Answer: B) The business may face fines, penalties, or confiscation of goods

Explanation: Exporting goods without an Export Registration Certificate (ERC) is illegal in many countries and may lead to serious consequences, including fines, penalties, and the possible confiscation of goods. It is essential to ensure that an ERC is obtained before engaging in export activities.

ERC (Required Documents / Papers)

a. ERC Application form dully fill-up

b. Nationality, Assets Certificates of the proprietor/partnership deed of partnership firm / Memorandum and Article of Association of Limited Company.

c. Bank Certificate.

d. Trade license.

e. Income Tax Certificate along with TIN.

f. Any other documents as per current Export Policy of prescribed fees, concerned CCI & E office issue IRC and ERC.

On completion of required formalities and payment of prescribed fees, concerned CCI & E office issue IRC and ERC.

IRCs and ERCs are renewed every year on payment of prescribed fees.

For Import and Export of goods / services normally Letters of Credit are used as means of payment.

MCQ :Import Registration Certificate (IRC)

Question 1: What is the primary purpose of an Import Registration Certificate (IRC)?

A) To register the importer with customs authorities

B) To allow the importer to buy goods from overseas

C) To track the customs duties paid

D) To ensure compliance with local taxation laws

Answer: A) To register the importer with customs authorities

Explanation: The Import Registration Certificate (IRC) is a document issued by customs or a designated government body that registers the importer. It allows them to engage in importing goods legally and facilitates customs clearance. The IRC is required for compliance with import laws and regulations.

Question 2: Who is typically required to obtain an Import Registration Certificate (IRC)?

A) Only businesses with international trade agreements

B) All entities intending to import goods into a country

C) Only manufacturers importing raw materials

D) Only individuals importing luxury items for personal use

Answer: B) All entities intending to import goods into a country

Explanation: Any business, organization, or individual who intends to engage in importing goods into a country must obtain an IRC. This ensures that they are recognized by customs authorities and can legally carry out imports.

Question 3: Which of the following documents is usually required to apply for an Import Registration Certificate (IRC)?

A) Taxpayer Identification Number (TIN)

B) Bank statement showing funds for trade

C) Personal identification card

D) Ownership certificate of a warehouse

Answer: A) Taxpayer Identification Number (TIN)

Explanation: One of the key documents required to apply for an IRC is the Taxpayer Identification Number (TIN). It ensures that the applicant is registered with the tax authorities and complies with tax obligations. Other supporting documents like business registration or proof of address may also be needed.

Question 4: What is the validity period of an Import Registration Certificate (IRC)?

A) 1 year

B) 5 years

C) 10 years

D) It does not have an expiration date

Answer: B) 5 years

Explanation: The validity period for an Import Registration Certificate (IRC) can vary depending on the country, but it is generally issued for a period of 5 years. After this period, the certificate must be renewed.

Question 5: Can the Import Registration Certificate (IRC) be transferred from one business to another?

A) Yes, it can be transferred by submitting a transfer request

B) No, it is non-transferable

C) Yes, but only to another company in the same industry

D) Yes, but only if the new business is located in the same region

Answer: B) No, it is non-transferable

Explanation: The Import Registration Certificate (IRC) is specific to the entity that applied for it. It is non-transferable, meaning that if a business changes ownership or structure, the new entity must apply for a new IRC.

Question 6: Which government authority typically issues the Import Registration Certificate (IRC)?

A) Ministry of Commerce or Trade

B) Customs authorities

C) Local government agencies

D) Ministry of Finance

Answer: A) Ministry of Commerce or Trade

Explanation: In many countries, the Import Registration Certificate (IRC) is issued by the Ministry of Commerce or the Ministry of Trade. Customs authorities play a role in enforcing import regulations, but the actual registration process is typically handled by the Ministry of Commerce.