Top banks in Alaska 2022

- First National Bank Alaska

First National Bank Alaska was established in 1922.This is the only local community bank which provides a comprehensive range of banking services. It is the 3rd largest financial institutions of Alaska.

Stock price: FBAK (OTCMKTS) $256.00 -3.50 (-1.35%)

Aug 22, 12:26 PM EDT

Headquarters: Anchorage, Alaska, United States

Total assets: 3.81 billion USD (2019)

Founded: 1922

Net income: 55.6 million USD (2019)

Number of employees: 650+

Subsidiary: First National Bank Alaska Profit Sharing & 401(k) Plan

Website: https://www.fnbalaska.com/

Top banks list in Alaska 2022

2. Wells Fargo

Wells Fargo is a diversified, community-based financial services company with 53 banking, mortgage, insurance and investment offices and 120 ATMs in 28 Alaskan communities from Ketchikan to Barrow. It provides you the accessibility of physical and mobile banking. The personal banking options include credit cards, checking and savings accounts, loans, and investment products. But product availability may alter from area to area.

Wells Fargo routing number

Domestic Wire Transfer : 121000248

International Wire Transfer to Wells Fargo account in the USA: 121000248

SWIFT Code : WFBIUS6S

Website: www.wellsfargo.com

3 . BBVA

BBVA compass is Alaska’s bestbank in mobile banking. It has a leading, award-winning mobile banking app. Hence, it helps meet your requirements with a wide range of personal, business, small business and enterprise product options. Their mobile banking app is quite easy to navigate.

This bank offers you checking accounts, savings, credit cards and other loan options. Some of these features are available nationwide, and some of them are available in select regions.

If you are wondering, who keeps the most money in this bank; Check out these richest people in Alaska who own the most wealth in the state.

BBVA USA was a bank headquartered in Birmingham, Alabama. It was a subsidiary of Banco Bilbao Vizcaya Argentaria from 2007 until 2021, when it was acquired by PNC Financial Services. It operated mainly in Alabama, Arizona, California, Colorado, Florida, New Mexico, and Texas.

Customer service: 00 1 866-342-2512

CEO: Javier Rodríguez Soler (Jan 2019–)

Successor: PNC Financial Services

Headquarters: Birmingham, Alabama, United States

Founder: Harry B. Brock Jr.

Parent organizations: Banco Bilbao Vizcaya Argentaria, PNC Financial Services

Subsidiaries: Simple, BBVA Compass Financial Corporation

4. Axos Bank

Axos Bank is an American federally chartered savings and loan association and direct bank headquartered in San Diego, California. It is the main consumer brand of Axos Financial.

Total assets: 13.9 billion USD (2020)

Headquarters location: San Diego, California, United States

Founded: July 4, 2000, San Diego, California, United States

Number of employees: 1,100 (2020)

Parent organization: Axos Financial

Founders: Jerry F Englert, Gary Lewis Evans

5. CIT Bank

CIT is a division of First Citizens Bank, the largest family-controlled bank in the United States,

continuing a unique legacy of strength, stability and long-term thinking that has spanned generations.

Parent company, First Citizens BancShares, Inc. (NASDAQ: FCNCA) is a top 20 U.S. financial institution

with more than $100 billion in assets. The company’s commercial banking segment brings a wide array of

best-in-class lending, leasing and banking services to middle-market companies and small businesses

from coast to coast. First Citizens also operates a nationwide direct bank and a network of more than

600 branches in 22 states, many in high-growth markets. Industry specialists bring a depth of expertise

that helps businesses and individuals meet their specific goals at every stage of their financial journey.

Pros

- Competitive APYs

- No monthly fees

- Mobile and online access 24/7

- Mobile check deposit capabilities

- Small minimum deposit requirements

- FDIC insured

Cons

- No physical locations

- No checkbooks for eChecking accounts

- No IRAs

- No auto loans

- No credit cards

Customer service: 00 1 626-535-8964

Headquarters location: Pasadena, California, United States

Founded: 2000

6. Denali State Bank

Denali State Bank

Aaron Pletnikoff, Chief Lending Officer, SVP

(907) 458-4228 or (907) 378-6777

119 North Cushman Street, Suite 100 Fairbanks AK 99701-2897

Phone Number

1-888-458-4291

(907) 456-1400

(888) 458-4291

(907) 458-4248

Fairbanks, AK 99701

Routing number is 125200921.

Hours:

Lobby Hours: 10am-5pm Monday – Friday

Highlights of Denali State Bank

- Personal Banking

- Business Banking

- Loans & Credit

Services Offered by Denali State Bank

- Auto Loans

- Business Banking

- Cashier’s Checks

- Checking Accounts

- Merchant Services

- Money Orders

- Mortgages

- Personal Loans

- Savings Accounts

- Bill Pay

- Business Loans

- Certificate of Deposits

- Credit Cards

- Money Market Accounts

- Mortgage Refinancing

- Personal Banking

- Safety Deposit Boxes

Visit Website: www.denalistatebank.com

Monday: 10:00 AM – 5:00 PM

Tuesday: 10:00 AM – 5:00 PM

Wednesday: 10:00 AM – 5:00 PM

Thursday: 10:00 AM – 5:00 PM

Friday: 10:00 AM – 5:00 PM

Saturday: Closed

Denali State Bank is a private company. The company currently specializes in the Banking area. Its headquarters is located at Fairbanks, Alaska, USA. The number of employees ranges from 25 to 100. The annual revenue of Denali State Bank varies between 5.0M and 25M. To connect with Denali State Bank employee register on SignalHire.

Headquarters Location

119 N Cushman St, Fairbanks, Alaska, 99701 US

Denali State Bank Employees Size

100-200 employees

SIC Code

6199, 6199

DMA Code

Fairbanks Metropolitan Area

Founded

1991

Estimated Annual Revenue

$5.0M – 25M

Operating Status

Independent Company

7. Northrim Bank

Northrim Bank is a commercial bank started its operation as a public traded company. Its mission is to be the most trusted bank by Alaskan people. Its headquartered in Anchorage, Alaska, committed to providing Customer First Service. They specialize in serving businesses, professionals, and individual Alaskans who are looking for personal service and value. (Jul 17, 2022) Contribute to the growth of the community by funding projects that have a positive impact on the society.

Website: https://www.northrim.com/

Routing Number: 125200934

Swift Code: Not Available

Mobile App: Android | iPhone

Telephone Number: 800-478-2265

Headquartered In: Alaska

Founded: 1990 (32 years ago)

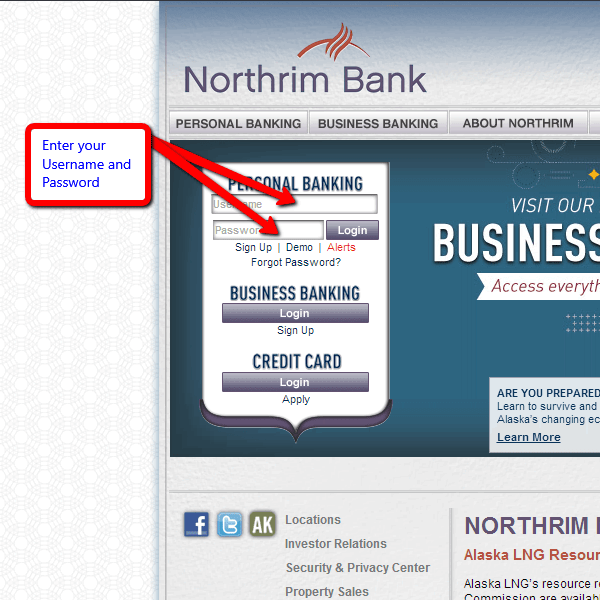

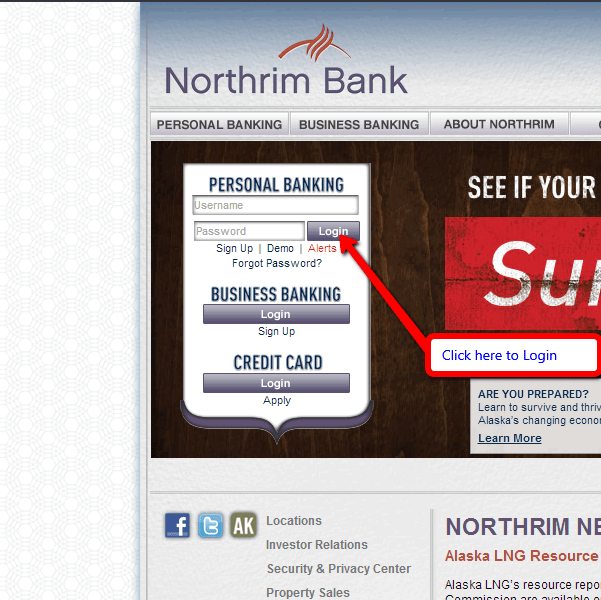

How to login in Northrim Bank

Step :1 – Copy the address https://www.northrim.com/, which will take you directly to our homepage.

Step: 2 – On the left-hand side of the homepage, you will see two boxes requiring Username and Password under ‘PERSONAL BANKING.’

Step: 3 – Input your details and click on Login to submit and then you will be ready to go.

Top banks in Alaska 2022

8. Key Bank

KeyBank, the primary subsidiary of KeyCorp, is a regional bank headquartered in Cleveland, Ohio. It is the only major bank based in that city. KeyBank is 24th on the list of largest banks in the United States. KeyBank’s customer base spans retail, small business, corporate, and investment clients.

Customer service: 00 1 716-838-8600

Headquarters: Cleveland, Ohio, United States

Founded: 1825, Albany, New York, United States

Key people: Christopher M. Gorman (Chairman, CEO and President); Donald R. Kimble, (CFO)

Number of locations: 1,197 branches

Number of employees: 17,999 (2019)

Key Bank location in the state of Alaska:

Key Bank

9041 Old Seward Hwy,Anchorage

99515 AK (Alaska)

Key Bank

100 Cushman St,Fairbanks

99515 AK (Alaska)

Key Bank

401 N Santa Claus Ln,North Pole

99515 AK (Alaska)

Key Bank

44260 Sterling Hwy,Soldotna

99515 AK (Alaska)

Key Bank

422 Marine Way E,Kodiak

99515 AK (Alaska)

Key Bank

2501 S Tongass Ave,Ketchikan

99515 AK (Alaska)

Key Bank

487 Salmon Way Ste 101,Dutch Harbor

99515 AK (Alaska)

Key Bank

1150 S Colony Way #7,Palmer

99515 AK (Alaska)

Top banks in Alaska 2022

9. Mt. Mckinley Bank

Mt. McKinley Bank was formed as a Mutual Savings Bank on December 3rd, 1965. The goal of our bank was to encourage financial growth through savings and thrift. In addition, we wanted to provide a local alternative for those residents seeking home mortgages. Startup capital for the bank consisted of $357,000 in debentures that were issued rather than common stock. Those debentures were repaid to the investors and to this day we are a “mutual” institution.

Mt. McKinley Bank has adopted the vast banking technology through NetLink online banking platform. It gives you the convenience of banking 24-hours a day, seven days a week, from the comfort of your home or workplace or on the road. The services allow you to pay and receive bills, view account balances, receive account transaction alerts and much more.

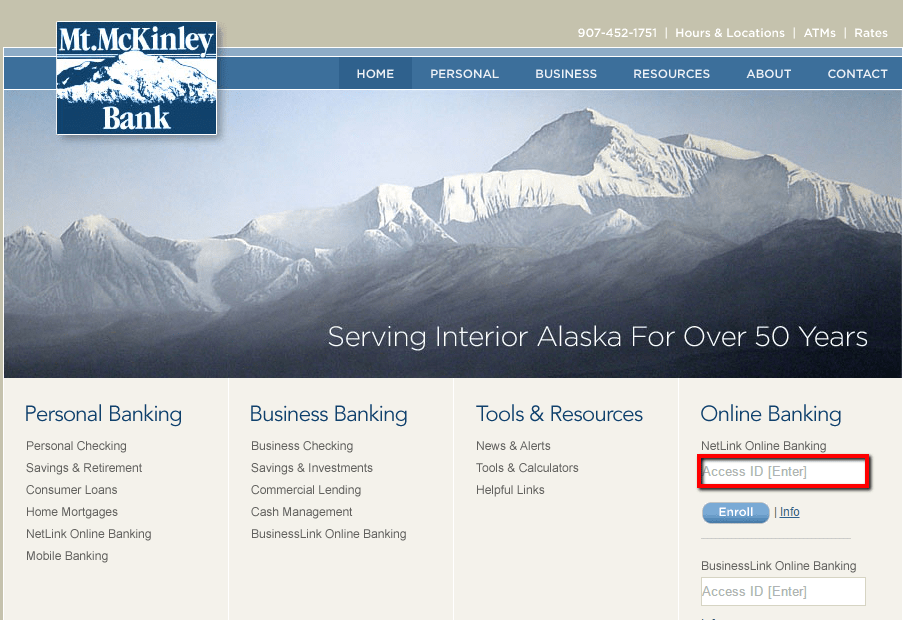

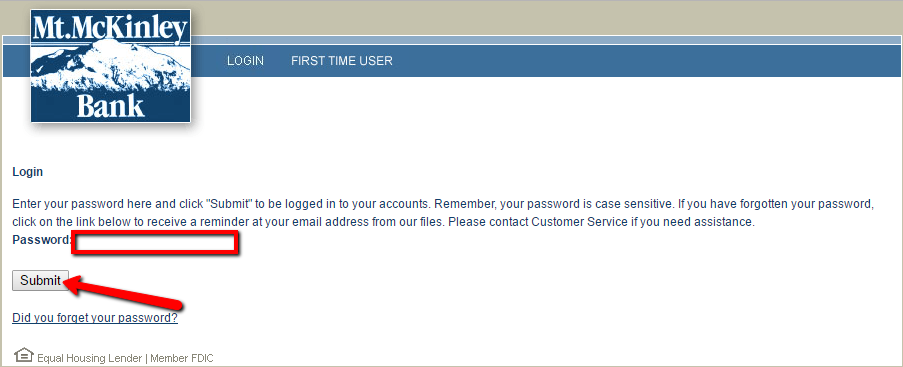

How to login in Mt. McKinley Bank:

Enrolled users can follow the steps below to log in to the online banking service:

Step : 1 – Click this link http://www.mtmckinleybank.com/ to open the bank website

Step :2 – Under NetLink Online Banking, enter your Access ID then press Enter Key

Step: 3 – Enter your Password then Submit

Enrolled online banking users at Mt. McKinley Bank can:

- Transfer funds between accounts

- Review updated statements and account activity

- View and manage pending payments

- View account balances

- Pay bills

- Schedule recurring or future transfers

Website Address: https://www.mtmckinleybank.com