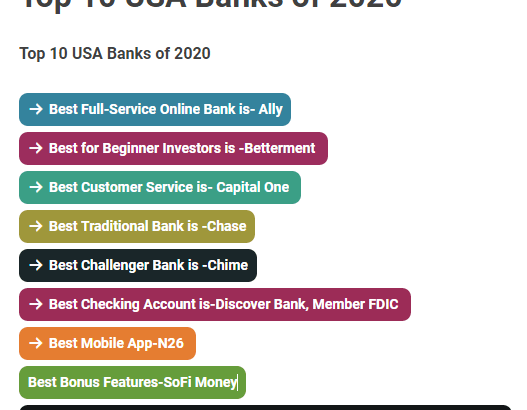

Top 10 USA Banks of 2020

Top 10 USA Banks of 2020

Best Full-Service Online Bank is- Ally

Best for Beginner Investors is -Betterment

Best Customer Service is- Capital One

Best Traditional Bank is -Chase

Best Challenger Bank is -Chime

Best Checking Account is-Discover Bank, Member FDIC

Best Mobile App-N26

Best Bonus Features-SoFi Money

Best CD Accounts- SynchronyBest Hybrid Investment Bank-Wealthfront

I have search USA bank on google. I have found an article is written by Saundra Latham, Contributor for The Simple Dollar.

I think it is a most valuable banking information for the banker so I like to include my banking blog.

ALLY best online service Bank in USA in April 2020

ALLY is the best Full services online Bank

Ally is a bank which is best bank of USA of 2020 considering their online services.Ally has over 43,000 ATMs in the U.S., but since it’s an online bank, there are no brick-and-mortar branch locations; all business and customer support is conducted online or over the phone.

Ally has various services such as :

Savings: Ally offers two main options: an online savings account and a money market account.

Checking: There’s just one checking option, but it’s a good one: no-fee interest checking.

CDs: Choose from three account options: the High-Yield CD, with seven terms ranging from three months to five years; the Raise Your Rate CD, with a two- or four-year term; or the 11-month No Penalty CD.

IRA savings and CDs: Ally offers an IRA online savings account, or you can choose an IRA High-Yield CD or an IRA Raise Your Rate CD.

IRA plans: Traditional, Roth, and SEP IRAs are available, too.

Ally’s Online Savings account main features:

No minimum deposit: You don’t need any certain amount to open your account, unlike some other banks that will require an initial deposit of $250, $500, or even $1,000 or more.

No account maintenance fees: You also won’t pay a monthly fee to keep your account open, regardless of your balance.

A very high interest rate: Your deposits will earn 1.50% APY currently.

Mobile check deposit: It’s as simple as snapping a photo of a check with your smartphone using Ally eCheck Deposit.

24/7 account access and customer service: Get the convenience of online banking or connect with a customer service agent regardless of the time.

Simple transfers: Move your money easily by scheduling transfers up to a year in advance, and link up to 20 external accounts to your Ally account.

Best for Beginner Investors “Betterment” of USA April 2020

Betterment is not a bank. What started as essentially a robo-advisor for investors expanded into offering some cash management accounts, called Betterment Everyday. The Betterment Everyday Savings account is available now while the Betterment Everyday Checking account will be available later this year. You can join the waiting list for checking on their website, and that will allow you to earn the highest savings rate available. These accounts are offered through partner or affiliate banks. Although Betterment is not a bank, these partnerships mean it can offer bank-like products.

Betterment every day at a glance

Betterment every day checking & savings accounts

The Everyday Checking account is still under development, although you can join a waitlist on Betterment’s site. What it promises is totally fee-free checking. ATM fees, no matter where you use the ATM, will be refunded. The account will come with a Visa debit card, and there is no minimum balance. Although you won’t earn interest on your balance, it is easily paired with Betterment’s high-yield Everyday Savings.

Everyday Savings replaces the former Smart Saver accounts and comes with an exceptional interest rate of 1.37% APY. This means it far outperforms any brick and mortar bank out there and lines up with other online and direct banks. After a $10 minimum deposit to open, there is no minimum balance, there are no program fees.

Betterment money market accounts, Betterment CDs, Betterment IRA accounts, Betterment credit cards, Betterment investing, The bottom line: The new Betterment Everyday Checking and Everyday Savings may have a pretty universal appeal, with no fees and high savings yields, as long as you’re fine with online banking and no branches. As for investing, Betterment is great for beginners, with low fees and some great tools. If you’re just starting out, or more of a hands-off type investor, there are some great portfolio options for you.If you’re more of a hands-on investor or are looking for mutual funds, CDs, and other more diversified investments that are not ETFs, you’ll want to look elsewhere. Unless you have a lot to invest, if you want human interaction and an active advisor, Betterment is not the right place for you.

Capital One is the Best Customer Service provider in USA April 2020

Capital One at a Glance

Capital One products that aren’t as common for online-only banks. Here are the key offerings:

Savings: Capital One 360 offers personal, business, and kid-focused savings accounts.

Checking: There are a no-fee personal checking account and a teen-friendly checking account that links to a debit card and helps teach your child how to manage money.

CDs: Choose from nine terms ranging from six to 60 months when you want to amp up your personal or business savings.

Mortgages: Whether you need a fixed- or adjustable-rate mortgage, Capital One 360 has you covered at competitive interest rates.

Investment accounts: With the Capital One Investing platform, you can build a portfolio of stocks, ETFs, and mutual funds. You can also open an IRA.

Capital One Highlights:

No hidden fees or minimums as you earn interest on your everyday money

38,000 fee-free Allpoint® ATMs and 2,000 Capital One® ATMs

Free MasterCard® Debit Card for all purchases

Mobile check deposits with CheckMateSM & one checkbook’s free

Capital One 360 launched in 2013 after Capital One acquired ING Direct and rebranded the service. As a former ING Direct customer, I “inherited” a Capital One 360 savings account that I still use today, and I can personally attest to the convenience and ease of use it offers.

Capital One account features at a glance:

No maintenance fees: At other banks, you may have to pay a fee just to have an account.

No account minimums: You don’t have to have a certain amount of money to open an account or maintain any sort of minimum balance to avoid a fee.

A great rate: You’ll earn 1.50% APY, more than eight times the national average.

Open multiple accounts: You can have up to 25 different savings accounts for free.

24/7 account access: Need to make a withdrawal at 2 a.m.? No problem.

Customer support any day of the week: You’re just a phone call away from a real person.

Easy account management: Schedule stress-free automatic deposits, and track your progress with the My Savings Goals feature.

Mobile check deposit: Depositing funds is as simple as snapping a picture with your phone using the CheckMate feature.