Step to RBC Online Banking

Step-by-Step Guide to RBC (Royal Bank of Canada) Online Banking:

Step 1: Enroll in RBC Online Banking

If you are a new user:

Go to RBC Online Banking Sign-Up Page

Click “Enroll Now” or “Sign up for Online Banking.”

Provide:

RBC Client Card or Credit Card number

Postal code

Account verification (via phone/email or card PIN)

Set your username and password

Confirm your registration

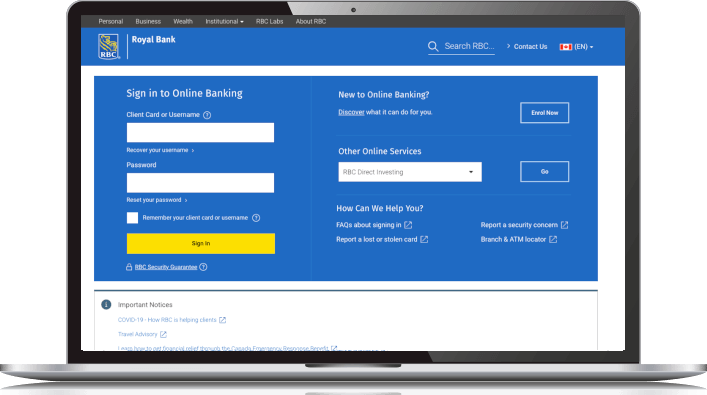

Step 2: Log in to RBC Online Banking

Visit: RBC Online Banking Login

Click on “Sign In” in the top-right corner

Enter your Client Card Number or Username

Enter your Password

Click “Sign In.”

Step 3: Navigate the Dashboard

After logging in, you’ll see your account summary including:

Chequing/Savings accounts

Credit cards

Investments

Loans & mortgages

You can:

View balances

Download eStatements

Review transaction history

Step 4: Perform Transactions

From the menu, you can:

Transfer funds between RBC accounts

Pay bills (utilities, credit cards, etc.)

Send Interface e-Transfers

Set up pre-authorized payments

Schedule future payments

Step 5: Manage Your Settings

You can:

Change passwords and security questions

Update email and mobile alerts

Set up 2-step verification

Link external accounts

Step 6: Use the RBC Mobile App (Optional but recommended)

Download from the App Store or Google Play

Log in using the same credentials

Enjoy features like:

Fingerprint/Face ID login

Mobile cheque deposit

Location-based ATM/branch finder

Step 7: Ensure Security

Log out after each session

Do not share your password

Monitor your account regularly for unauthorized activity

Step 8: Access Advanced Banking Features

Once you’re comfortable with the basics, explore these features:

Recurring Payments & Transfers

Set up automatic transfers (e.g., saving a fixed amount every month)

Automate bill payments to avoid late fees

Track Investments

View your RBC Direct Investing accounts

Monitor mutual funds, RRSPs, TFSAs, GICs, and more

Use online tools for portfolio performance tracking

Tax Documents & Statements

Download year-end tax documents (e.g., T5, T4RSP)

View historical eStatements (up to 7 years)

Apply for New Products

Open a new account (e.g., chequing, savings)

Apply for loans, mortgages, or credit cards

Get instant pre-approval decisions online

Step 9: RBC Security Features

RBC prioritizes security in online banking:

✅ Two-Step Verification

Enabled during login or when making sensitive changes

Involves a code sent via SMS or email

RBC Digital Banking Security Guarantee

If unauthorized transactions occur, RBC guarantees full reimbursement if you’ve met security responsibilities

Best Practices

Use strong, unique passwords

Turn on transaction alerts

Regularly review account activity

Never share your login information, even with family

Step 10: Get Help & Support

If you need assistance:

Online Support

Use the “Ask NOMI” chatbot for quick help

Visit the RBC Help Centre

Call RBC

From Canada: 1-800-769-2511

24/7 customer service is available for banking help

Visit a Branch

Use the Branch Locator on the website or app to find the nearest RBC branch or ATM

Optional: Link External Accounts & Services

Link accounts from other financial institutions for consolidated views

Integrate RBC with budgeting apps or tax software (e.g., QuickBooks, TurboTax)

Summary Checklist

✅ Enroll in RBC Online Banking

✅ Sign in securely

✅ Access account details & history

✅ Transfer money & pay bills

✅ Use the mobile app for on-the-go banking

✅ Set alerts and enable two-step verification

✅ Apply for new products and manage investments

✅ Contact support if needed

VIDEO SCRIPT: “How to Use RBC Online Banking – Full Tutorial”

[Opening Scene: Upbeat music + RBC Logo animation]

Narrator:

“Welcome to this quick and easy tutorial on how to use RBC Online Banking! Whether you’re a new user or need a refresher, we’ll walk you through everything—step by step.”

Scene 1: Introduction

[On screen: RBC website homepage, zooming into the ‘Sign In’ button]

Narrator:

“RBC, or Royal Bank of Canada, offers one of the most secure and user-friendly online banking platforms. Let’s start by signing up.”

Scene 2: How to Enroll

[On screen: Hover over ‘Online Banking’ > Click ‘Enroll Now’]

Narrator:

“To enroll, go to rbcroyalbank.com and click on ‘Enroll Now’ under Online Banking. You’ll need your RBC Client Card or Credit Card, postal code, and some account details.”

[On screen: Form filling demo with placeholder info]

Narrator:

“Create a secure username and password, and you’re good to go!”

Scene 3: Logging In

[On screen: RBC homepage > Sign In > Login page]

Narrator:

“Now that you’re registered, return to the homepage and click ‘Sign In.’ Enter your Client Card number or username, followed by your password.”

[On screen: Demo login process]

Scene 4: Exploring the Dashboard

[On screen: Account Summary page with balances, recent transactions]

Narrator:

“Once logged in, you’ll see your Account Summary—showing balances for chequing, savings, credit cards, loans, and investments.”

Scene 5: Transferring Money and Paying Bills

[On screen: Click ‘Pay Bills’ > select a payee > enter amount]

Narrator:

“To pay a bill, click on ‘Pay Bills,’ choose your payee, and enter the amount. You can also transfer funds between accounts or send Interac e-Transfers.”

Scene 6: RBC Mobile App

[On screen: RBC app on phone, user logging in with Face ID]

Narrator:

“Don’t forget the RBC Mobile App—available on iOS and Android. You can check your balances, deposit cheques, and even send e-Transfers on the go.”

Scene 7: Security Tips

[On screen: 2-Step Verification screen, security alerts setup]

Narrator:

“Enable two-step verification, set up email alerts, and regularly change your password. RBC also offers a Digital Banking Security Guarantee.”

Scene 8: Getting Support

[On screen: RBC Help Center page, call RBC screen]

Narrator:

“Need help? Use the chatbot ‘Ask NOMI’ or call RBC directly at 1-800-769-2511. Their support is available 24/7.”

✅ Closing Scene: Recap

[On screen: Checklist animation]

Narrator:

“Let’s recap:

✔️ Sign up for Online Banking

✔️ Log in securely

✔️ Pay bills & transfer funds

✔️ Use the mobile app

✔️ Stay safe with strong passwords & alerts

✔️ Contact support when needed.”

Narrator (Call to Action):

“If you found this video helpful, don’t forget to Like, Subscribe, and hit the bell icon for more tutorials!”

[On screen: Subscribe button animation + RBC logo + website link]

Screen Recording Script: RBC Online Banking – Step-by-Step Guide

Intro Scene (10–15 sec)

Voiceover:

“Welcome! In this tutorial, you’ll learn how to use RBC Online Banking—from signing up, logging in, to making payments and staying secure.”

On Screen:

Show RBC logo

Navigate to rbcroyalbank.com

Highlight or zoom in on the “Sign In” button

Step 1: Enroll in RBC Online Banking (30 sec)

Voiceover:

“If you don’t already have an account, click on ‘Enroll Now’ under the Online Banking section.”

On Screen:

Hover over “Banking” in the top nav

Click Online Banking > Enroll Now

Fill out fake data for demonstration (Client Card, Postal Code)

Show form steps briefly: set username/password, confirm info

Step 2: Logging In (20 sec)

Voiceover:

“Once you’re registered, head back to the homepage and click ‘Sign In’. Enter your Client Card or username and your password.”

On Screen:

Return to homepage

Click Sign In

Enter sample login credentials (blur out or use a demo account)

Click Submit/Login

Step 3: Explore the Dashboard (30 sec)

Voiceover:

“After logging in, you’ll land on the dashboard. Here you can view all your accounts, recent transactions, and account balances.”

On Screen:

Hover over Chequing, Savings, and Credit Card accounts

Click one account to show the transaction history

Show eStatement download option

Step 4: Pay Bills & Transfer Money (45 sec)

Voiceover:

“To pay a bill, go to ‘Pay Bills’, select a payee, enter the amount, and click continue. You can also send e-Transfers or schedule recurring payments.”

On Screen:

Click “Pay Bills.”

Select a payee (e.g., Hydro One)

Enter an amount and submit

Navigate to “Interac e-Transfer” > Send Money

Enter the recipient email, amount, and security question

Step 5: RBC Mobile App (25 sec)

Voiceover:

“You can also use the RBC Mobile App to bank on the go. Log in with Face ID or fingerprint and access all the same features.”

On Screen:

Show phone screen recording

Open the RBC app

Log in via biometric

Show home screen, quick balances, and bill payment

Step 6: Set Up Security (30 sec)

Voiceover:

“Enable two-step verification for extra protection. You can also set transaction alerts by email or SMS.”

On Screen:

Go to Profile or Settings

Show “Security” tab

Enable 2-Step Verification

Go to Alerts > Set up low balance or withdrawal alerts

Step 7: Get Help (20 sec)

Voiceover:

“If you need support, use the Ask NOMI chatbot or call RBC directly. Their Help Centre is available 24/7.”

On Screen:

Show the Help link at the top

Click “Ask NOMI” chatbot

Hover over Contact numbers or FAQ links

✅ Final Scene: Recap & Call to Action (15–20 sec)

Voiceover:

“Now you know how to use RBC Online Banking. Like and subscribe for more helpful tutorials!”

On Screen:

Quick flash through: Dashboard > Pay Bills > Mobile App

Show a checklist animation of what was covered

End with subscribe animation and RBC logo