Significant Changes in UCPDC-600

Significant Changes in UCPDC-600

Compared with Publication no. 500

*******

#Article :1 :It has been expressly indicated that UCP600 contains rules.

# :2 :All the parties including Banks and Clients have been categorically defined. Also different terminologies have been clarified.

# :3: :All the interpretations of UCP 500 have been compiled in a single Article

of UCP 600.

Besides this article indicates credit is always “irrevocable”

# :4 :No change except inclusion of a sub article of UCP 500 i.e., credit instrument should not include copies of contract/proforma as integral part.

# :5 :No change with the relevant circular of publication No. 500

# :6 :This article represents combination of articles………..of UCP 500.

# :7:This article represents liability and responsibility of LC issuing bank. It

also emphasizes on liability in the event nominated bank fails or refuses to perform their responsibility in any situation.

# :8 : Negotiation, without recourse.

# :9 :Advice should accurately reflect terms and conditions of the Credit or amendment received.

# :10: If the beneficiary fails to give such notification a presentation that complies with the credit and to not yet accepted amendment will be deemed to be notification by the beneficiary of such amendment.

# :11 :A pre-advice constitutes an irrevocable undertaking to issue details of LC.

# :12 : Nomination of a bank authorizes to purchase/negotiate documents..

# :13 : The credit must state if the reimbursement is subject to ICC rules for bank to bank reimbursement.

# :14 : Standard of Examination of Documents : complying presentation 5 (five)

banking days following the day of presentation.

# :15 : Complying presentation – issuing bank/confirming bank must honour

complying presentation. Nominated bank if negotiates docs it must forward the same to the confirming bank/issuing bank

# :16 : Discrepant Documents :

Beneficiary – nominated bank.

# :17 : Original Documents.

# :18 : Commercial invoice.

# :19 : Requirement of mentioning capacity of the Agent is omitted. Carrier’s

right to effect transshipment is to be disregarded.

# :20 : Same

# :21 : Non-negotiable Sea way bill (Ref :Publication of ICC titled “UCPDC400-500 compared” of page – 72)

- It is widely used in European, Scandinavian, North America and certain Far Eastern trade areas.

- To avoid delay in handling the goods once they arrived at the port of discharge.

- It is not considered as a traditional negotiable bill of lading or a documents of title.

# :22 : Charter Party

- Master owner & Charterer

- Name of the carrier is not necessary.

* Charterer may issue and sign Bill of Lading

** “If a credit calls for ————-“ omitted.

# :23 : The information appearing in the box on the air transport document

(marked “for carrier uses only or similar expression) relative to the flight

number and date will not be considered a specific notations of such

date of dispatch” omitted.

# :24 : Language restructured keeping most of the text same as was in UCP 500

Other changes : Additions

“ if rail transport document does not identify the carrier, any signature or standing of the railway company will be accepted ———- signed by the carrier.

- A road transport doc must appear to be the original.

- A rail transport doc marked duplicate will be accepted as sign.

- A rail or water way transport doc will be accepted as —- whether marked as original or not”

# :25 : * If a credit calls for ——— — omitted

* In all other respects meets the stipulation of the credit ———- omitted. * Word stipulates substituted by “states”

* Language of other texts are structured.

# :26 : Unless otherwise stipulated ———— omitted.

# :35 : Disclaim on Transmission and Translation.

Even Documents are lost in transit, Issuing bank / Confirming bank

bound to reimburse.

# :38 : Transfer:

* Nominated or specially authorized incase credit is available with any

* Presentation must be made to the transferring bank.

*It has not been made clear whether transferring will hold the responsibility of the payment against transferred LC.

Comment of Gary Collyer– Technical Advisor to the ICC Commission:

“The eUCP allows for presentation electronically or for a mixture of paper documents and electronic presentation”.

Scope of eUCP:

Presentation of paper documents and electronic records.

eUCP & UCP:

Definition:

Appear on their face : Examination : Data content of an electronic record

Document :Electronic record.

Sign : Electronic signature.

Electronic signature : Authentication of electronic record.

Presentation: # Electronic record may be presented separately and need not be presented at a time.

# Notice of completeness to be given

Examination: # Hyperlink

# Forwarding of records by the nominated bank signifies that it has satisfied itself as to the apparent authenticity of the electronic records

# Inability of the issuing bank/ confirming bank to examine records shall not be basis of refusal

Transport: :Issuance date.

Hyperlink

Significant Changes in UCPDC-600

Compared with Publication no. 500

*******

#Article:1 :The word “Rule” has been incorporated.: Application.

# :2 :Definitions: Different terminologies/ parties involved in DC have

been defined

# :3: :Interpretations: A good number of articles in publication no.500 have

been set under this article.

Besides this article indicates credit is always “irrevocable”

# :4 :No significant changes with relevant article of 500- Credit vs Contract.

Enclosing of Proforma invoice/Indent/Contract with the credit instrument has been discouraged, which also prevails in 500.

# :5 :No change. Document vs Goods/services/performance.

# :6 :It relates to types of credit of article 10 of UCP-500.

Requirement of expiry date and place of presentation in the credit has been set.- Availability.

# :7 :Issuing bank undertaking:

Text of the article is almost same with respect to UCP-500.

Undertaking to the beneficiary is independent of undertaking the

reimbursing bank.

# :8 :Almost same. – Confirming bank undertaking.

Exception: Negotiation, without recourse.

In UCPDC 500 liabilities & responsibilities of issuing & confirming bank were expressed jointly.

# :9 : Advising of Credit & Amendment:

Advice should accurately reflect terms and conditions of the Credit.

# :10 : Confusion arises about the meaning of the sentence “If the beneficiary

fails ………………………. of such amendment.”

Article

# :11 : No change. (Teletransmission)

# :12 : Nomination: Nomination does not impose obligation.

# :13 : BTB reimbursement.

# :14 : Standard for Examination of Documents : 5 (five) banking days.

# :15 : Presentation is complying – it must honour.

# :16 : Discrepant Documents :

Beneficiary – nominated bank.

# :17 : Original Documents.

# :18 : Commercial invoice.

# :19-20 : Transport Documents.

# :35 : Disclaim on Transmission and Translation.

Even Documents are lost in transit, Issuing bank / Confirming bank

bound to reimburse.

# :38 : Transfer:

*Nominated or specially authorized incase credit is available with any

*Presentation must be made to the transferring bank.

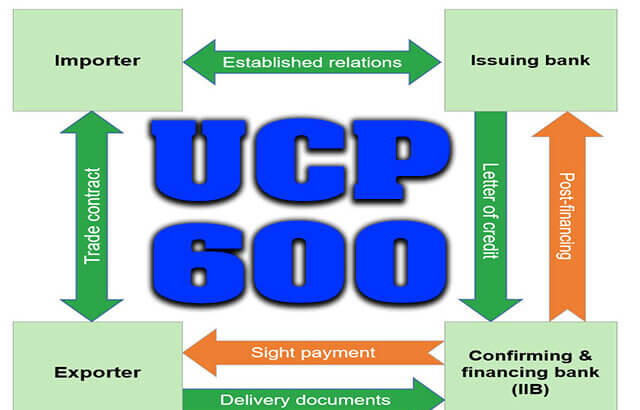

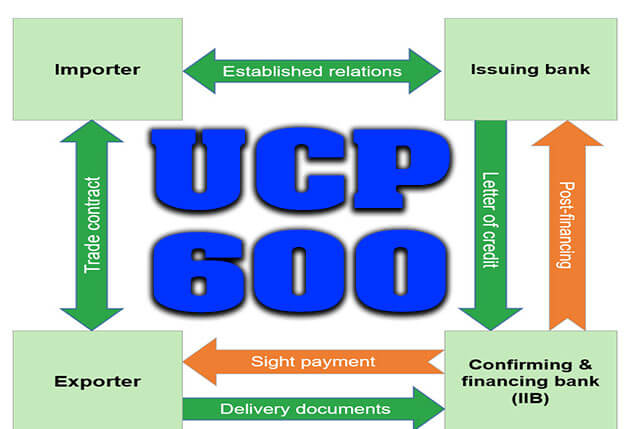

The Uniform Customs and Practice for Documentary Credits, UCP 600 (2007 Revision, ICC Publication No. 600), introduced several significant changes compared to its predecessor, UCP 500 (1993 Revision). The primary goals were to reduce ambiguity, streamline the rules, and lower the historically high rate of document rejection.

Here are the most significant changes:

1. Streamlined Structure and Language

-

Fewer Articles: The total number of articles was reduced from 49 to 39, making the rules more concise and easier to navigate.

-

Irrevocable Credit is the Default: The concept of a Revocable Credit was eliminated. Under UCP 600, all credits are considered irrevocable unless otherwise expressly stated.

-

New Articles for Definitions and Interpretations:

-

Article 2 (Definitions): Introduces a dedicated article for key terms like “Honour,” “Negotiation,” and “Complying Presentation,” which were either poorly defined or scattered in UCP 500.

-

Article 3 (Interpretations): Consolidates rules for interpreting certain terms and conditions, aiming for a single, uniform understanding.

-

2. Standardized Time Frames (The “Five-Day Rule”)

-

Fixed Examination Period: UCP 600 introduced a maximum fixed period of five banking days following the day of presentation for a bank to examine documents and determine if they constitute a complying presentation.

-

Replaced “Reasonable Time”: This crucial change replaced the vague and dispute-prone term “reasonable time” used in UCP 500, providing greater certainty to all parties.

3. Clarified Bank Undertakings and Actions

-

Defined “Honour” and “Negotiation”:

-

Honour is defined to mean payment at sight, incurring a deferred payment undertaking, or accepting a draft.

-

Negotiation is clearly defined as the purchase of drafts and/or documents by the nominated bank.

-

-

Complying Presentation: This new concept (Article 2) clarifies that a presentation must comply with: (a) the terms and conditions of the credit, (b) the applicable UCP rules, and (c) International Standard Banking Practice (ISBP).

-

Notice of Refusal: The requirements for a bank to give notice of refusal (Article 16) were made stricter and clearer, emphasizing that the notice must state all discrepancies for which the bank refuses to honour or negotiate.

4. Documentation Changes

-

Originals: Article 17 provides clearer rules on what constitutes an original document, generally accepting any document that appears to be original on its face, such as those made by ink, wet stamp, or that are indicated as original.

-

Non-Documentary Conditions: Article 14(h) was strengthened to clearly state that banks will disregard any condition in the credit that does not require the presentation of a document.

-

Transhipment: The rules concerning transhipment in transport documents were made more flexible. For a multimodal transport document, a term referring to transhipment is acceptable even if the credit prohibits transhipment (Article 19).

These changes collectively addressed the most common causes of disputes and document rejection under UCP 500, making the Letter of Credit a more efficient and reliable trade finance tool.