Digital Bank in Bangladesh

Table of Contents-Digital Bank in Bangladesh

- Introduction

- The Rise of Digital Banking in Bangladesh

- Benefits of Digital Banking

- Challenges Faced by Digital Banks in Bangladesh

- Security and Trustworthiness of Digital Banks

- Role of Government and Regulatory Bodies

- Digital Banking Services Offered in Bangladesh

- The Future of Digital Banking in Bangladesh

- Conclusion

- FAQs (Frequently Asked Questions)

Introduction

In recent years, the banking sector in Bangladesh has witnessed a significant transformation with the advent of digital banking. Digital banks have emerged as a convenient and efficient alternative to traditional brick-and-mortar banks. This article explores the growth of digital banking in Bangladesh, its benefits, challenges, and the role of government and regulatory bodies in fostering its development.

The Rise of Digital Banking in Bangladesh

The rise of digital banking in Bangladesh can be attributed to several factors. Firstly, the rapid advancement of technology and increased internet penetration have made it possible for more people to access banking services digitally. With the widespread availability of smartphones, individuals can now perform various banking transactions anytime and anywhere.

Secondly, the younger generation in Bangladesh, which is more tech-savvy, has embraced digital banking as a preferred method of managing their finances. They appreciate the convenience of online banking services, such as fund transfers, bill payments, and account management, which can be done within a few clicks.

Furthermore, the COVID-19 pandemic has accelerated the adoption of digital banking in Bangladesh. The lockdown measures and social distancing guidelines necessitated a shift towards contactless banking solutions. Digital banks were quick to adapt and offer seamless online services, ensuring uninterrupted access to financial services for individuals and businesses.

Benefits of Digital Banking

Digital banking offers numerous benefits to both customers and banks. For customers, it provides a convenient and time-saving way to manage their finances. They can perform transactions, check account balances, and track their expenses with ease. Digital banking also eliminates the need to visit physical branches, saving customers valuable time and effort.

In addition, digital banking services often come with competitive interest rates and lower fees compared to traditional banks. This allows customers to maximize their savings and enjoy better financial returns.

For banks, digital banking reduces operational costs associated with maintaining physical branches and handling large volumes of paperwork. It also enables banks to collect and analyze customer data, facilitating personalized banking experiences and targeted marketing campaigns.

Challenges Faced by Digital Banks in Bangladesh

Despite the growth of digital banking, there are certain challenges that digital banks in Bangladesh face. One of the major challenges is the digital divide. While internet penetration has increased significantly, there are still segments of the population with limited access to the internet and digital devices. Bridging this gap is essential to ensure that digital banking services reach all sections of society.

Another challenge is the issue of cybersecurity. As digital transactions become more prevalent, the risk of cyber threats and fraud also increases. Digital banks need to invest in robust security measures and educate customers about best practices to protect their financial information.

Moreover, there is a need for continued collaboration between digital banks and traditional banks. Digital banks need to establish partnerships with existing banking infrastructure to ensure seamless interoperability and enable customers to transition smoothly between digital and traditional banking channels.

Security and Trustworthiness of Digital Banks

Security and trustworthiness are paramount when it comes to digital banking. Customers must have confidence that their financial information and transactions are secure. Digital banks in Bangladesh employ various security measures, including encryption, multi-factor authentication, and real-time transaction monitoring, to safeguard customer data.

To enhance trust, digital banks are regulated by the Bangladesh Bank, the central bank of Bangladesh. The regulatory framework ensures that digital banks adhere to strict standards and comply with anti-money laundering and customer protection regulations.

Role of Government and Regulatory Bodies

The government of Bangladesh recognizes the potential of digital banking in promoting financial inclusion and driving economic growth. It has taken several initiatives to create an enabling environment for digital banks to thrive. The government has formulated policies to encourage digital innovation in the banking sector and has provided support in terms of infrastructure development and regulatory frameworks.

The Bangladesh Bank plays a crucial role in regulating digital banks and ensuring their compliance with regulatory requirements. It oversees the licensing process for digital banks and monitors their operations to maintain stability and protect consumer interests.

Digital Banking Services Offered in Bangladesh

Digital banks in Bangladesh offer a wide range of services to meet the diverse needs of customers. These services include:

- Account opening and management

- Fund transfers and payments

- Mobile wallet integration

- Bill payments and recharge services

- Loan applications and approvals

- Investment and wealth management

- Insurance services

- Virtual debit and credit cards

- Real-time transaction tracking and notifications

- Personalized financial planning tools

These services empower customers to take control of their finances and enjoy a seamless banking experience.

The Future of Digital Banking in Bangladesh

The future of digital banking in Bangladesh looks promising. With increasing smartphone penetration and the government’s focus on digitalization, the adoption of digital banking services is expected to grow further. Digital banks will continue to innovate and introduce new features to enhance customer experience and meet evolving financial needs.

Moreover, digital banking will play a crucial role in driving financial inclusion in Bangladesh. It will provide banking services to underserved areas and populations, making financial services more accessible and affordable for all.

Digital banking in Bangladesh has transformed the way people manage their finances. With the convenience of digital platforms, individuals can perform banking activities at their fingertips. Whether it’s checking account balances, paying bills, or transferring funds, digital banking provides a seamless and efficient experience.

The user-friendly interfaces of digital banking apps make it easy for customers to navigate through various features and services. They can view their transaction history, set up automatic payments, and even apply for loans or credit cards. The convenience and accessibility of digital banking have made it a popular choice among Bangladeshis seeking modern and efficient banking solutions.

One of the key advantages of digital banking is the speed of transactions. Traditional banking processes often involve paperwork and manual approval processes, which can be time-consuming. In contrast, digital banking enables instant fund transfers and payments. Whether it’s sending money to a friend or making an urgent bill payment, digital banking ensures swift and hassle-free transactions.

Another significant benefit of digital banking is the availability of round-the-clock services. Traditional banks have specific operating hours, and customers may need to wait in queues for service. With digital banking, customers have the flexibility to access their accounts and perform transactions anytime, anywhere. This is particularly beneficial for those with busy schedules or those who reside in remote areas where physical bank branches may be limited.

Digital banks in Bangladesh also offer personalized financial planning tools and insights. Through data analysis and AI-powered algorithms, digital banking platforms can provide customers with tailored financial advice and recommendations. Customers can track their expenses, set savings goals, and receive alerts and notifications to help them stay on top of their financial health.

However, it’s essential to address concerns regarding the security and trustworthiness of digital banking in Bangladesh. While digital banks implement robust security measures, such as encryption and multi-factor authentication, customers must also take precautions to protect their personal information. It is advisable to use strong and unique passwords, regularly update the banking app, and avoid accessing banking services through unsecured Wi-Fi networks.

Furthermore, the role of government and regulatory bodies is crucial in ensuring the stability and integrity of the digital banking sector. The Bangladesh Bank plays a vital role in regulating digital banks and ensuring compliance with industry standards. Regular audits, monitoring of transactions, and enforcing stringent cybersecurity measures are part of their responsibilities to protect customers’ interests.

As the digital banking landscape in Bangladesh continues to evolve, it is expected that more innovative services will be introduced. Open banking, for instance, allows customers to share their financial data securely with third-party applications to access additional services and insights. This collaborative approach promotes competition and encourages the development of innovative financial solutions.

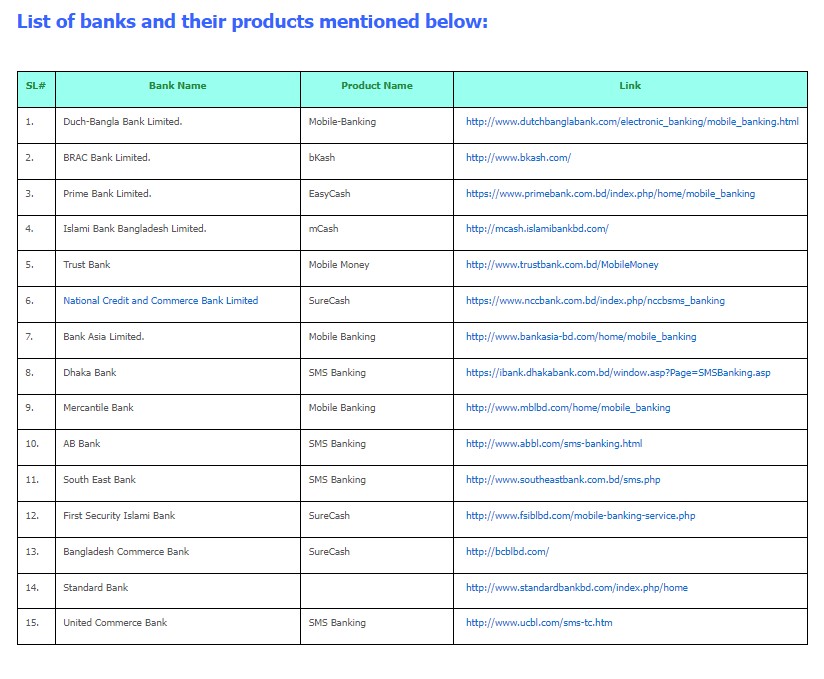

List of digital banks in Bangladesh:

- bKash: bKash is a popular digital banking service in Bangladesh that allows users to perform financial transactions through their mobile phones. It offers services such as mobile wallet, fund transfers, bill payments, and merchant payments.

- Nagad: Nagad is a government-owned digital financial service provider in Bangladesh. It provides a range of services including mobile banking, utility bill payments, fund transfers, and e-commerce transactions.

- Rocket: Rocket is a mobile banking service offered by Dutch-Bangla Bank Limited. It enables users to access their bank accounts, transfer funds, pay bills, and make online purchases using their mobile phones.

- Upay: Upay is a digital banking platform that offers a wide range of financial services, including mobile wallet, fund transfers, bill payments, airtime top-ups, and merchant payments.

- SureCash: SureCash is a mobile banking and payment solution that allows users to send and receive money, pay bills, and make online purchases. It also offers services such as micro-insurance and savings accounts.

- iPay: iPay is a digital wallet and payment gateway that enables users to make secure online transactions, pay bills, and transfer funds. It also offers merchant services for businesses.

- Ok Wallet: Ok Wallet is a mobile financial service provided by ONE Bank Limited. It offers features such as mobile banking, fund transfers, bill payments, and airtime top-ups.

- mCash: Islami Bank Bangladesh Limited, one of the leading Islamic banks in Bangladesh, offers its own mobile banking service called “Islami Bank mCash.” It is a convenient and secure way for customers to perform various financial transactions using their mobile devices, adhering to the principles of Islamic banking.

- Trust Bank Mobile Money: Trust Bank Mobile Money is a digital banking service offered by Trust Bank Limited. It enables users to perform various financial transactions, including fund transfers, bill payments, and mobile top-ups.

- EBL SKYBANKING: EBL SKYBANKING is the mobile banking platform of Eastern Bank Limited. It provides users with access to their bank accounts, fund transfers, bill payments, and other banking services through their mobile devices.

These are some of the prominent digital banks in Bangladesh that offer convenient and secure financial services to individuals and businesses. Please note that the availability of specific services may vary among different digital banks.

Conclusion

In conclusion, digital banking has revolutionized the banking sector in Bangladesh, offering convenience, speed, and accessibility to customers. With the advancement of technology and the increasing adoption of digital platforms, the future of digital banking in Bangladesh looks promising. However, it is essential for customers to remain vigilant about their security and for regulatory bodies to ensure a robust and trustworthy digital banking ecosystem.

Digital banking has emerged as a game-changer in the banking sector of Bangladesh. It offers convenience, efficiency, and financial inclusion to individuals and businesses. With the right regulatory framework, investments in technology infrastructure, and collaborative efforts between digital banks and traditional banks, the future of digital banking in Bangladesh looks promising. Embracing digital banking will undoubtedly contribute to the country’s economic growth and empower individuals with enhanced financial capabilities.

FAQs (Frequently Asked Questions)

Q1: Can I access digital banking services from anywhere in Bangladesh? Yes, digital banking services can be accessed from anywhere in Bangladesh as long as you have an internet connection and a compatible device.

Q2: Are digital banking services secure? Yes, digital banks employ robust security measures to protect customer data and transactions. Encryption, multi-factor authentication, and real-time monitoring are some of the security features implemented by digital banks.

Q3: Can I open an account with a digital bank without visiting a branch? Yes, digital banks offer the convenience of opening an account online without the need to visit a physical branch. The account opening process can be completed through a mobile app or website.

Q4: Can I transfer funds between digital banks and traditional banks? Yes, digital banks often establish partnerships with traditional banks to enable seamless fund transfers between the two. Customers can transfer funds between digital and traditional bank accounts.

Q5: What happens if I lose my mobile device with the digital banking app installed? If you lose your mobile device, it is essential to contact your digital bank immediately. They will assist you in securing your account, disabling access from the lost device, and re-establishing access on a new device.

Islami Bank Bangladesh Limited, one of the leading Islamic banks in Bangladesh, offers its own mobile banking service called “Islami Bank mCash.” It is a convenient and secure way for customers to perform various financial transactions using their mobile devices, adhering to the principles of Islamic banking.

Here are some key features and services provided by Islami Bank mCash:

- Mobile Wallet: Islami Bank mCash allows users to create a mobile wallet linked to their mobile phone numbers. This wallet serves as a digital account for storing funds securely.

- Fund Transfers: Users can easily transfer money from their mCash wallet to other mCash users, individuals with accounts in Islami Bank, or even to recipients with accounts in other banks. This feature enables seamless and instant person-to-person transfers.

- Bill Payments: Islami Bank mCash enables users to pay their utility bills, including electricity, water, gas, and internet bills, conveniently through their mobile wallets. It eliminates the hassle of visiting payment centers or standing in long queues.

- Mobile Recharge: With Islami Bank mCash, users can recharge their mobile phone balances instantly. This feature ensures continuous communication without the need to visit physical recharge points.

- Merchant Payments: Users can make payments at various partner merchants, including retail stores, restaurants, and online platforms, using their Islami Bank mCash wallet. This convenient payment option promotes a cashless society in line with Islamic banking principles.

- ATM Cash Out: Islami Bank mCash allows users to withdraw cash from their mobile wallet at designated ATMs. This feature provides easy access to funds even if users do not have a physical bank account.

- Statement and Transaction History: Users can view their transaction history and account statements through the Islami Bank mCash mobile app or by requesting SMS alerts. This feature helps users keep track of their financial activities and promotes transparency.

To start using Islami Bank mCash, users typically need to register for an mCash account with Islami Bank Bangladesh Limited and complete the necessary Know Your Customer (KYC) requirements. The registration process may involve providing identification documents and other relevant information.

Islami Bank mCash prioritizes the security and confidentiality of user data and transactions. Users are encouraged to follow recommended security measures, such as setting strong passwords, not sharing sensitive information, and keeping their mobile devices updated with the latest security patches.

Please note that specific features and services offered by Islami Bank mCash may be subject to change or additional options may be available. For the most accurate and up-to-date information, it is recommended to visit the official website of Islami Bank Bangladesh Limited or contact their customer service.

Digital Bank in Bangladesh

Digital Bank in Bangladesh

Digital Bank in Bangladesh