Clearing: Definition-Types-Steps-Benefits-Limitations

Ever wondered how money moves so smoothly between banks, stock exchanges, or businesses? The secret lies in a process called clearing. It might sound complex, but it’s something we interact with more often than we realize—whether paying for your morning coffee, transferring funds, or trading stocks.

In this article, we’ll dive into what clearing really means, explore its types, walk through the steps involved, and highlight the benefits and limitations you should know. Ready? Let’s clear things up!

What is Clearing?

Simply put, clearing is the process of confirming, reconciling, and finalizing financial transactions between two parties before the actual transfer of money or assets occurs. It acts as the crucial middle step that ensures both sides agree on the terms and amounts to be exchanged.

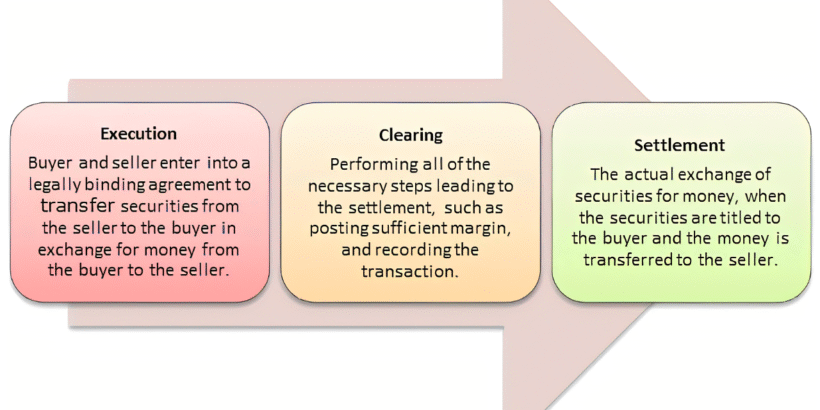

Clearing vs. Settlement

It’s common to hear clearing and settlement used interchangeably, but they are different. Clearing involves all the checks and balances that prepare a transaction for completion, while settlement is the actual exchange of funds or assets.

Types of Clearing

Clearing can take several forms depending on the context and the financial market involved:

Bilateral Clearing

This is a direct clearing process between two parties without involving a third party. Imagine you and a friend agreeing to settle your dues personally.

Multilateral Clearing

Here, multiple parties’ transactions are netted out together, often through a clearing house, minimizing the number of transactions and money exchanged.

Centralized Clearing

Transactions are cleared through a central entity—called a clearing house—that acts as an intermediary guaranteeing the trade’s completion.

Decentralized Clearing

In this system, transactions are cleared directly between parties without a central clearing entity, often relying on bilateral agreements.

Clearing Houses and Their Role

A clearing house is a critical institution that facilitates centralized clearing, reducing risk and boosting efficiency in financial markets.

How Clearing Works

At its core, clearing involves collecting transaction details, verifying them, netting out amounts, and preparing instructions for settlement. Think of it like balancing accounts between friends after a group dinner to figure out who owes what.

Clearing Cycle Explained

The cycle typically starts when a trade or payment is initiated and ends when the final settlement occurs—this cycle can take minutes or several days depending on the market.

Steps Involved in the Clearing Process

- Initiation of Transaction: A trade or payment instruction is made.

- Verification and Validation: Confirming transaction details and checking for errors.

- Netting of Payments: Offsetting debits and credits among multiple parties to reduce the number of transactions.

- Confirmation: Both parties confirm the transaction details.

- Settlement Instruction: Preparation of instructions for the actual transfer of funds or securities.

- Final Settlement: Exchange of money or assets to complete the transaction.

Benefits of Clearing

Why does clearing matter? Here are some key advantages:

Risk Reduction

Clearing helps reduce counterparty risk, meaning the chance one party won’t fulfill their end of the deal.

Increased Efficiency

By netting transactions, clearing reduces the volume of payments, speeding up processes.

Cost Savings

Fewer transactions mean lower processing costs and less strain on resources.

Transparency and Accountability

Centralized clearing provides a clear audit trail, enhancing trust in the system.

Enhancing Trust in Financial Markets

With clearing, participants feel safer trading, which supports market stability.

Limitations of Clearing

However, clearing isn’t flawless. Some challenges include:

Systemic Risk

If a clearing house fails, it could disrupt the entire financial system.

Operational Risks

Mistakes, fraud, or technical failures can occur in the clearing process.

Dependence on Technology

Outages or cyberattacks can halt clearing operations.

Cost of Infrastructure

Setting up and maintaining clearing systems is expensive.

Legal and Regulatory Challenges

Clearing must comply with complex laws, which can vary internationally.

Clearing in Different Financial Markets

Clearing plays unique roles in various markets:

- Stock Markets: Ensures shares and money are exchanged correctly.

- Derivatives Markets: Manages complex contracts’ clearing to reduce risk.

- Foreign Exchange Markets: Coordinates currency trades between banks.

- Payment Systems: Processes everyday transactions like debit card payments.

Role of Clearing Houses

What is a Clearing House?

A clearing house is a middleman ensuring both sides meet their obligations.

Functions of a Clearing House

- Netting transactions

- Guaranteeing trades

- Managing risk through margin requirements

- Providing transparency

Examples of Prominent Clearing Houses Worldwide

- CME Clearing (USA)

- Clearnet (Europe)

- National Securities Clearing Corporation (NSCC)

Technological Innovations in Clearing

Tech is changing clearing fast!

Automation and Digital Clearing

Automated systems speed up clearing and reduce errors.

Blockchain and Distributed Ledger Technology

These technologies promise real-time, transparent clearing without traditional intermediaries.

Clearing vs. Settlement

Remember, clearing sets the stage, and settlement closes the deal. Both are vital for smooth financial operations.

How Clearing Impacts You as a Consumer

Every time you use a credit card, pay bills online, or transfer money, clearing ensures your transaction goes through correctly and securely.

Global Clearing Systems

Cross-border trades require efficient international clearing infrastructure to manage currency differences and regulations.

Future Trends in Clearing

- Movement towards real-time clearing and settlement

- Increasing regulation to safeguard markets

- More integration with fintech innovations

Conclusion

Clearing may work behind the scenes, but it’s absolutely essential for the financial world to function smoothly. From reducing risks to boosting efficiency, clearing keeps money moving and markets trustworthy. As technology evolves, so will clearing systems—making our transactions faster, safer, and more transparent than ever.

Frequently Asked Questions (FAQs)

Q1: What is the main difference between clearing and settlement?

Clearing is the process of verifying and preparing a transaction, while settlement is the actual exchange of funds or assets.

Q2: Why is clearing important in financial markets?

It reduces risk, increases efficiency, and ensures trust between parties.

Q3: Can clearing happen without a clearing house?

Yes, through bilateral or decentralized clearing, but clearing houses provide added security and efficiency.

Q4: How does technology impact clearing?

Technology automates processes, reduces errors, and introduces innovations like blockchain for faster clearing.

Q5: What risks are associated with clearing?

Operational failures, systemic risks if clearing houses fail, and legal challenges are some key concerns.

Clearing is the process of collection of proceeds of instruments of different banks by a collecting bank through some systematic procedures with the involvement of Central Bank.

Types of instruments:

- Cheques (CD, SB, Loan)

- Demand Draft

- Payment Order

- Others

Related Terms:

- Crossing

- Clearing Stamp

- Endorsement

Clearing Sessions:

- High Value

- High Value (return house)

- Regular

- Regular (return house)

Inward (at branch):

- Receive all instruments from system

- Verify clearing stamp, crossing, endorsement etc

- Debiting respective account

- Ensure honor/dishonor in the system

- Corresponding with main branch (if necessary)

Outward clearing (at branch):

- Receive all instrument form the clients

- Crediting the same in respective account

- Prepare instruments of clearing

- Scanning & transfer to the system

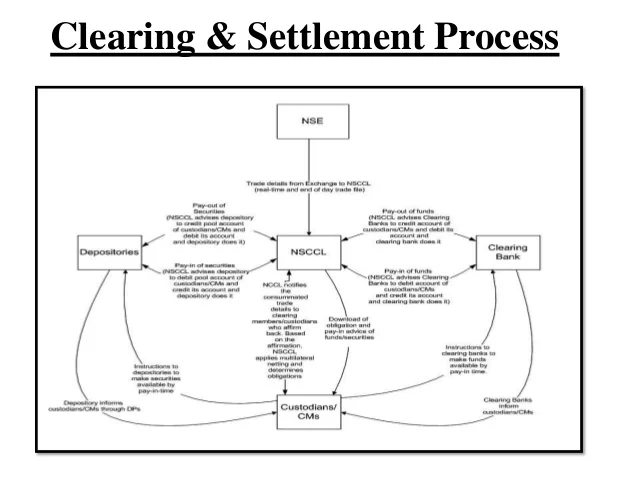

Function of Main Branch :

- Receiving images of inward of all instruments and transfer to different branches.

- Scanning of clearing instruments for outward clearing and transfer to Bangladesh Bank end.

- Preparing voucher for inward, outward and return house and matching with Bangladesh Bank settlement.

- Ensure branches claims through issuing IBCA & IBDA.

- Corresponding with Bangladesh Bank

- Corresponding with other banks

- Preservation of all instruments

- Rectification of various dispute

- Over all supervision

About BACH Program:

Elaboration: Bangladesh Bank Automated Clearing House.

Important Features of BACH :

- Images of instruments is considered for clearing process.

- Settlement made through wave

- Physical movement of officers not required

- PBM : Presenting Bank Module

- CPS : Cheque Processing System

- Work Station

- Batch & Run

- Routing number

- Scanner

- BACH Program manager

Common Problems :

>> Less claim by other bank

>> Excess claim by other bank

>> Less claim by our bank

>> Excess claim by our bank

>> Fail to attend the clearing session