First Security Islami Bank PLC

First Security Islami Bank PLC (FSIBL) is recognized for its commitment to providing Shariah-compliant financial services. It has made significant contributions to the financial sector in Bangladesh through innovative and customer-centric banking solutions. The bank was inaugurated on October 25, 1999, and transitioned to a full-fledged Islamic bank on January 1, 2009 (FSIBBD).

[wptabs id=”14934″]

FSIBL’s mission is to deliver the best customer experience and create long-term value for shareholders. It provides a wide array of services including deposit schemes, investment options, internet banking, mobile financial services, and foreign remittance partnerships (FSIBBD) (FSIBLBD Cloud). The bank uses multiple delivery channels to ensure easy access for its customers, including branches, sub-branches, ATM booths, and an app-based internet banking system (FSIBBD).

The bank has also demonstrated a strong financial performance. In 2023, FSIBL reported a net income of BDT 3.28 billion and maintained a capitalization of BDT 10.24 billion. It also showed a consistent growth in sales, reaching BDT 16.17 billion in 2023 (MarketScreener).

In terms of corporate social responsibility (CSR), FSIBL is actively involved in community development. It offers scholarships to meritorious students, operates a charity hospital, and runs a school. These initiatives are part of the bank’s broader commitment to social welfare and community support (Wikipedia) (FSIBLBD Cloud).

The bank is also known for its strategic focus on maintaining dynamic growth and adapting to changing customer needs. FSIBL’s long-term strategic plans emphasize progressive and innovative banking solutions, which have helped it maintain a competitive edge in the financial sector of Bangladesh (FSIBBD).

First Security Islami Bank PLC (FSIBL) continues to build its reputation as a leading Islamic bank in Bangladesh by focusing on strategic growth, customer satisfaction, and technological innovation. The bank operates under the principles of Islamic Shariah, which prohibits interest-based transactions and promotes ethical financial practices (FSIBBD).

Technological Innovations and Services

FSIBL has invested heavily in technology to provide convenient and efficient banking services. Their FSIBL Cloud platform offers internet and mobile banking, allowing customers to access their accounts, transfer funds, and perform other banking activities online. This digital transformation aligns with the bank’s goal to meet the evolving needs of its customers and stay competitive in the digital age (FSIBBD).

Financial Performance and Stability

The bank’s financial performance has been robust. FSIBL’s earnings and dividend recommendations reflect its solid financial health. For the year ending December 31, 2023, the bank recommended a cash dividend, demonstrating its commitment to rewarding shareholders. The bank’s net income for 2023 was BDT 3.28 billion, and its sales reached BDT 16.17 billion (MarketScreener). This growth highlights FSIBL’s ability to generate consistent profits and maintain financial stability despite economic challenges.

Corporate Governance and Transparency

FSIBL adheres to strict corporate governance practices to ensure transparency and accountability. The bank complies with the Corporate Governance Code and regularly updates its shareholders on financial performance and strategic decisions. This commitment to good governance helps build trust with investors and customers alike (FSIBBD).

Social Responsibility and Community Engagement

FSIBL’s corporate social responsibility (CSR) initiatives are an integral part of its operations. The bank funds scholarships for meritorious students, supports healthcare through its charity hospital, and contributes to education via its charity school. These initiatives underscore FSIBL’s dedication to giving back to the community and promoting social welfare (Wikipedia) (FSIBLBD Cloud).

Future Outlook

Looking ahead, FSIBL aims to continue its growth trajectory by expanding its service offerings and customer base. The bank plans to leverage technology further to enhance customer experience and operational efficiency. FSIBL’s strategic focus on innovation, customer satisfaction, and ethical banking practices positions it well for sustained success in the competitive banking sector of Bangladesh (FSIBBD).

Expansion and Infrastructure

FSIBL has continually expanded its infrastructure to enhance accessibility and convenience for its customers. The bank operates a wide network of branches, sub-branches, agent banking outlets, and ATMs across Bangladesh. This extensive network ensures that customers from various regions can access banking services easily (FSIBBD). Additionally, FSIBL has introduced modern banking facilities such as internet banking, SMS banking, and mobile banking, making it possible for customers to manage their finances remotely and efficiently.

Investment Products and Services

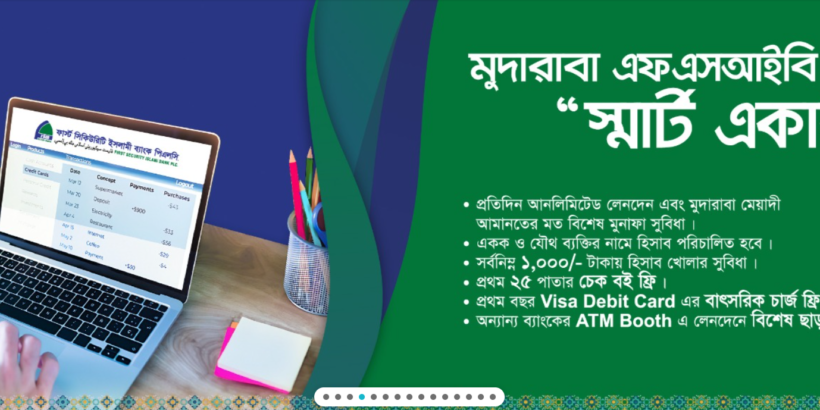

FSIBL offers a diverse range of investment products tailored to meet the financial needs of different customer segments. These products include various deposit schemes, such as savings accounts, fixed deposits, and specialized investment accounts that comply with Islamic banking principles (FSIBBD). The bank also provides a range of financing options for individuals, businesses, and entrepreneurs, helping to foster economic growth and development in the country.

International Banking Services

To cater to the needs of its international customers, FSIBL offers a comprehensive suite of foreign exchange and remittance services. These services facilitate the transfer of money across borders, making it easier for expatriates and businesses to manage their international financial transactions. The bank’s robust SWIFT network ensures secure and efficient international banking operations (FSIBBD).

Training and Development

FSIBL places a strong emphasis on the training and development of its employees. The bank has established a dedicated training institute to provide continuous learning opportunities for its staff. This focus on employee development ensures that the bank maintains high standards of service quality and professionalism, which are critical for sustaining customer trust and satisfaction (FSIBBD).

Awards and Recognitions

Over the years, FSIBL has received numerous awards and recognitions for its outstanding performance and contributions to the banking sector. These accolades reflect the bank’s commitment to excellence, innovation, and customer-centric banking. Such recognition not only boosts the bank’s reputation but also motivates it to continue striving for higher standards in service delivery and financial performance (FSIBLBD Cloud) (FSIBBD).

Environmental and Sustainable Practices

FSIBL is also committed to promoting sustainable banking practices. The bank has implemented various green banking initiatives to reduce its environmental footprint. These initiatives include promoting paperless banking, energy-efficient operations, and financing projects that support environmental sustainability. By integrating sustainability into its business operations, FSIBL aims to contribute positively to the environment and the community (FSIBBD).

Conclusion

First Security Islami Bank PLC stands out as a leading Islamic bank in Bangladesh, known for its innovative approach, strong financial performance, and commitment to social responsibility. With a strategic focus on customer satisfaction, technological advancements, and sustainable practices, FSIBL is well-positioned to continue its growth and contribute to the economic development of Bangladesh. The bank’s comprehensive range of products and services, coupled with its robust infrastructure and ethical banking practices, makes it a preferred choice for customers seeking reliable and Shariah-compliant financial solutions (Wikipedia) (FSIBLBD Cloud) (FSIBBD).