Central Bank of Bahrain

Central Bank of Bahrain: Features, History, Mission, Vision, and More

The Central Bank of Bahrain (CBB) stands as a cornerstone of Bahrain’s financial system, playing a critical role in shaping the nation’s monetary policies and fostering economic stability. Established as a modern regulatory authority, the CBB ensures the integrity and growth of Bahrain’s banking and financial sectors. This article explores the Central Bank of Bahrain in detail, covering its history, mission, vision, values, governance, and key functions.

Features of the Central Bank of Bahrain

The Central Bank of Bahrain is characterized by several defining features:

- Comprehensive Regulation: The CBB oversees all banking, insurance, and investment sectors within Bahrain.

- Monetary Stability: It maintains the Bahraini Dinar’s stability and ensures its effective exchange rates.

- Innovative Financial Policies: CBB supports fintech innovations and digital banking to position Bahrain as a financial hub.

- Global Standards: The institution aligns its policies with international financial regulations and practices.

History of the Central Bank of Bahrain

The history of the Central Bank of Bahrain is a testament to Bahrain’s progressive economic strategies:

- Foundation (1973): The Bahrain Monetary Agency (BMA) was established as the first central banking institution in Bahrain.

- Transition to CBB (2006): The BMA evolved into the Central Bank of Bahrain to reflect its expanded responsibilities and global alignment.

- Key Milestones: Over the decades, CBB has implemented groundbreaking regulations to modernize the financial sector and support innovation.

- Recent Updates (2024-2025): CBB has announced new initiatives to enhance sustainable finance, including green bonds and ESG-compliant frameworks to align with global environmental goals.

- Central Bank Digital Currency (CBDC): CBB has initiated feasibility studies for introducing a digital Bahraini Dinar.

- Partnerships: Collaborations with international financial institutions to strengthen Bahrain’s fintech ecosystem.

About the Central Bank of Bahrain

The CBB serves as Bahrain’s primary financial regulatory authority, with responsibilities ranging from monetary policy to overseeing financial institutions.

Mission

The Central Bank of Bahrain’s mission is:

“To ensure monetary and financial stability, contributing to Bahrain’s economic development.”

Vision

The vision of the CBB is:

“To be a leading central bank, promoting confidence in Bahrain’s financial system and fostering sustainable economic growth.”

Values

The core values of the CBB include:

- Integrity: Upholding ethical standards in all operations.

- Transparency: Ensuring clear communication with stakeholders.

- Innovation: Promoting forward-thinking financial practices.

- Excellence: Striving for high-quality regulatory and monetary oversight.

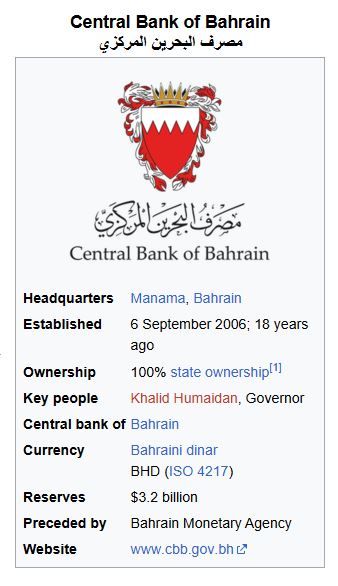

Headquarters

The Central Bank of Bahrain’s headquarters is located in the heart of Manama, Bahrain’s bustling capital. The modern building symbolizes Bahrain’s position as a leading financial hub in the Gulf Cooperation Council (GCC) region.

Address:

Central Bank of Bahrain P.O. Box 27, Manama, Kingdom of Bahrain

List of Governors

The governance of the Central Bank of Bahrain has been marked by the leadership of distinguished financial experts. Notable governors include:

- Abdulla Hassan Saif (1973–1987): First governor of the Bahrain Monetary Agency.

- Rasheed Al Maraj (2005–Present): Current governor of the CBB, overseeing major reforms and innovations.

Founding Year

The Central Bank of Bahrain was officially founded in 2006, succeeding the Bahrain Monetary Agency, which had been established in 1973.

Present Reserve

The CBB holds substantial foreign currency reserves to maintain monetary stability and ensure confidence in the Bahraini Dinar (BHD). As of the latest data, the CBB’s reserves are estimated at approximately $4.5 billion, though figures may fluctuate based on market dynamics.

Regulation

The Central Bank of Bahrain regulates a wide array of financial activities:

- Banking Sector: Ensures the stability and soundness of retail and wholesale banks.

- Insurance Industry: Oversees the operations of insurance companies.

- Capital Markets: Regulates Bahrain’s stock exchange and related activities.

- Fintech Development: Encourages innovation through regulatory sandboxes and supportive policies.

- Sustainable Finance: Promotes green financing initiatives and renewable energy investment.

- Crypto-Asset Regulation: Developed a robust framework to regulate crypto-assets, ensuring consumer protection and financial stability.

Monetary Policy

The CBB’s monetary policy aims to:

- Maintain price stability and curb inflation.

- Support the economic growth of Bahrain.

- Stabilize the Bahraini Dinar by pegging it to the US Dollar (1 BHD = 2.65957 USD).

- Address climate-related risks in monetary frameworks by incorporating sustainability considerations.

- Implement progressive financial inclusion strategies to benefit underserved communities.

Departments of the Central Bank of Bahrain

The CBB is organized into several specialized departments, including:

- Banking Services: Manages the accounts and reserves of domestic and international banks.

- Financial Stability: Monitors and mitigates systemic risks.

- Insurance Supervision: Regulates the insurance market.

- Fintech and Innovation: Facilitates the growth of financial technology.

- Sustainable Finance Unit: A newly established department focused on ESG-compliant financial products.

- Legal Affairs: Ensures compliance with international and local laws.

- Digital Transformation Unit: Focuses on implementing digital payment systems and blockchain-based solutions.

Functions of the Central Bank of Bahrain

The primary functions of the CBB include:

- Issuance of Currency: Managing the supply and circulation of the Bahraini Dinar.

- Monetary Policy Implementation: Ensuring economic stability through effective policies.

- Supervision of Financial Institutions: Monitoring the performance and compliance of banks, insurers, and investment firms.

- Consumer Protection: Safeguarding the interests of financial consumers.

- Promoting Financial Inclusion: Encouraging access to banking for all citizens.

- Green Finance Support: Advancing the adoption of environmentally sustainable financial practices.

- Digital Economy Support: Encouraging the transition to a cashless society through fintech initiatives.

Exchange Rate

The Bahraini Dinar (BHD) is pegged to the US Dollar at a fixed rate of 1 BHD = 2.65957 USD. This stable exchange rate policy has been pivotal in ensuring investor confidence and economic predictability.

Number of Employees

The Central Bank of Bahrain employs approximately 350 professionals, including economists, financial analysts, and administrative staff, all dedicated to achieving the institution’s objectives.

Website Address

For more information about the Central Bank of Bahrain, visit their official website:

Conclusion

The Central Bank of Bahrain plays an integral role in Bahrain’s economic and financial framework. Through its robust regulatory measures, innovative policies, and commitment to transparency, the CBB has positioned Bahrain as a leading financial center in the GCC. Its steadfast dedication to monetary stability and economic growth ensures a prosperous future for the Kingdom and its citizens.

By continuously adapting to global trends and fostering innovation, the Central Bank of Bahrain exemplifies excellence in central banking and financial regulation. Recent initiatives in sustainable finance, fintech, and the exploration of digital currencies highlight its forward-thinking approach, ensuring its relevance in the evolving global financial landscape.