Explain elaborately ” Role of central bank in developing countries: Traditional function, Economic growth, Internal stability, development of banking system, branch expansion, development of financial institutions, development of habits, training facilities, proper interest rate structure, other promotional roles”

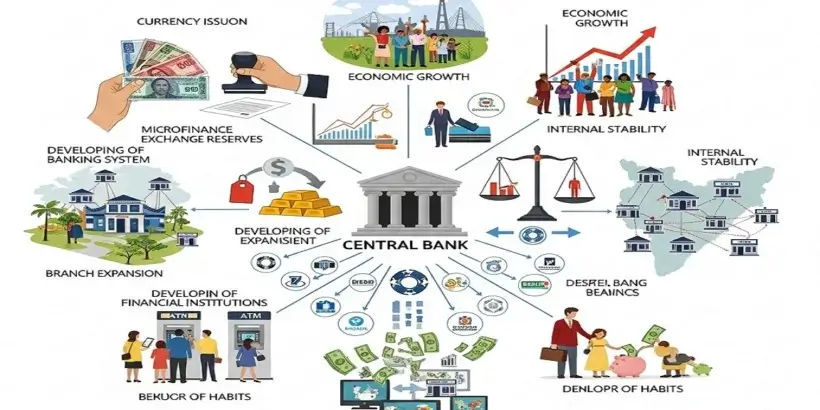

In developing countries, the central bank’s role is much broader than in advanced economies. Along with “traditional” central banking (currency + monetary policy), it also works as a builder of the financial system and a promoter of economic development.

Below is an elaborate, exam-style explanation under the headings you listed.

1) Traditional functions of the central bank

These are the basic duties every central bank performs:

-

Issue of currency: controls the supply of money and maintains public confidence in the currency.

-

Banker to government: keeps government accounts, manages payments/receipts, and helps in public debt operations.

-

Bankers’ bank: maintains reserve accounts of commercial banks and provides liquidity support.

-

Controller of credit (monetary policy): uses tools like policy rates, reserve requirements, and open market operations to regulate credit.

-

Custodian of foreign exchange reserves: manages reserves to meet external payments and reduce exchange rate instability.

-

Regulator/supervisor: sets rules for banks and ensures safety and soundness.

Why this matters in developing countries: financial markets are weaker and shocks spread faster—so these basic functions become even more critical.

2) Role in economic growth

In developing countries, the central bank actively supports growth by ensuring that credit goes to productive sectors and the financial system keeps expanding.

Key ways it supports growth:

-

Ensures availability of credit for agriculture, small industries, infrastructure, exports, etc.

-

Supports investment and production by keeping the financial system stable and credit flowing.

-

Guides banks to lend for development priorities (often via regulations, targets, refinance schemes, or incentives).

-

Encourages savings and mobilization of funds so investment can rise.

Important point: the central bank does not “directly” build roads or factories, but it creates conditions—credit, stability, institutions—that make growth possible.

3) Internal stability

Internal stability mainly means:

-

Price stability (control inflation/deflation)

-

Financial stability (avoid banking crises)

How it achieves internal stability:

-

Controls inflation by reducing excess credit/money supply when prices rise too fast.

-

Prevents deflation/recession by easing credit when demand is weak.

-

Maintains confidence in banks by regulation, supervision, and acting as lender of last resort.

-

Stabilizes the financial system so savings and investment aren’t disrupted.

In developing economies, inflation hurts the poor most, and bank failures can destroy trust quickly—so internal stability is a big development function too.

4) Development of banking system

Developing countries often start with:

-

limited banking reach,

-

weak management,

-

low public trust,

-

low savings in formal banks.

So the central bank works to strengthen the banking system by:

-

setting capital and liquidity rules,

-

improving governance and risk management,

-

encouraging modern banking practices (accounting, audits, technology),

-

protecting depositors indirectly through stability and supervision.

5) Branch expansion

A big development goal is taking banking to:

-

rural areas,

-

backward regions,

-

underserved communities.

Central bank supports branch expansion by:

-

encouraging/mandating banks to open branches in rural and semi-urban areas,

-

using policies for financial inclusion (basic accounts, payment access),

-

supporting low-cost delivery channels (agents, digital payments, mobile banking).

Result: more people save in banks, access credit, and use formal payment systems.

6) Development of financial institutions

Developing economies need specialized institutions for long-term and priority finance. The central bank helps by:

-

promoting/strengthening development financial institutions (for industry, housing, agriculture, exports, etc.),

-

supporting refinance institutions (which supply funds to banks to lend onward),

-

encouraging cooperative and rural credit institutions (where relevant),

-

improving the money market and government securities market to create strong financial foundations.

This builds an ecosystem beyond just commercial banks.

7) Development of habits (banking & saving habits)

Many developing economies have:

-

low savings in formal channels,

-

cash-based transactions,

-

reliance on informal lenders.

So central banks promote habits like:

-

saving through banks (safety + interest),

-

using formal payments (accounts, transfers),

-

financial literacy to reduce fear/mistrust of banks,

-

encouraging a shift from informal to formal finance.

Better habits → more deposits → more lendable funds → more development.

8) Training facilities

A strong banking system needs skilled people. Central banks help by:

-

setting up or supporting training institutions,

-

promoting training in credit appraisal, risk management, auditing, customer service,

-

upgrading banker skills for rural finance, SME lending, digital banking, and compliance.

Training improves efficiency and reduces bad loans and banking failures.

9) Proper interest rate structure

A “proper interest rate structure” means interest rates should:

-

encourage savings,

-

support productive investment,

-

avoid very high-cost borrowing,

-

be consistent with inflation and stability.

Central bank influences interest rates by:

-

setting policy rates (like repo/bank rate),

-

guiding how bank lending/deposit rates respond,

-

preventing unhealthy extremes (too low → inflation; too high → low investment),

-

supporting priority sectors where needed (sometimes through refinance or directed lending frameworks).

In developing countries, getting interest rates “right” is crucial because capital is scarce.

10) Other promotional roles

Other key promotional/development roles include:

-

Priority sector credit promotion: encouraging credit to agriculture, SMEs, weaker sections, education, etc.

-

Refinance and support schemes: enabling banks to lend more to targeted sectors.

-

Improving payment systems: making transactions faster and safer (digital infrastructure).

-

Research and policy guidance: advising government on monetary, banking, and development issues.

-

Encouraging competition and innovation: promoting better services, inclusive products, and tech adoption.

-

Consumer protection orientation: fair practices, transparency, complaint mechanisms (varies by country).

MCQs (25 Questions)

1. In developing countries, the role of the central bank is:

a) Limited to issuing currency

b) Only supervisory

c) Broader and developmental

d) Only regulatory

Answer: c

2. Which of the following is a traditional function of a central bank?

a) Branch expansion

b) Training bankers

c) Issue of currency

d) Financial literacy

Answer: c

3. Acting as banker to the government means:

a) Giving loans to public

b) Maintaining government accounts

c) Accepting public deposits

d) Financing industries

Answer: b

4. The central bank is called the “bankers’ bank” because it:

a) Lends to customers

b) Maintains reserves of banks

c) Accepts public deposits

d) Issues shares

Answer: b

5. Controller of credit refers to:

a) Accepting deposits

b) Issuing currency

c) Regulating credit supply

d) Granting loans

Answer: c

6. Custodian of foreign exchange reserves helps mainly in:

a) Reducing unemployment

b) Stabilising exchange rate

c) Increasing exports only

d) Financing government

Answer: b

7. Economic growth is promoted by the central bank mainly through:

a) Printing money

b) Ensuring credit to productive sectors

c) Increasing taxes

d) Reducing savings

Answer: b

8. The central bank does not directly build industries but:

a) Provides subsidies

b) Creates favourable financial conditions

c) Controls population

d) Manages trade

Answer: b

9. Internal stability refers to:

a) Balance of trade

b) Price and financial stability

c) Export promotion

d) Fiscal balance

Answer: b

10. Inflation control is achieved mainly by:

a) Increasing deposits

b) Reducing excess credit

c) Increasing subsidies

d) Expanding branches

Answer: b

11. Acting as lender of last resort helps in:

a) Increasing profits

b) Preventing bank failures

c) Expanding exports

d) Controlling population

Answer: b

12. Development of banking system includes:

a) Political reforms

b) Improving governance and risk management

c) Increasing taxation

d) Controlling trade

Answer: b

13. Branch expansion mainly aims at:

a) Profit maximisation

b) Inflation control

c) Financial inclusion

d) Export promotion

Answer: c

14. Opening rural and semi-urban branches helps in:

a) Reducing competition

b) Mobilising savings

c) Increasing informal lending

d) Reducing employment

Answer: b

15. Development of financial institutions is important to provide:

a) Short-term consumer loans

b) Long-term and priority finance

c) Government subsidies

d) Foreign aid

Answer: b

16. Refinance institutions mainly:

a) Lend to individuals

b) Supply funds to banks

c) Collect taxes

d) Regulate markets

Answer: b

17. Development of saving habits leads to:

a) Inflation

b) Cash hoarding

c) Higher bank deposits

d) Reduced growth

Answer: c

18. Promoting formal banking habits helps reduce:

a) Employment

b) Growth

c) Dependence on informal lenders

d) Exports

Answer: c

19. Training facilities provided by central banks aim to:

a) Increase population

b) Improve banking efficiency

c) Reduce interest rates

d) Increase inflation

Answer: b

20. Training in credit appraisal mainly helps in:

a) Increasing taxes

b) Reducing bad loans

c) Increasing borrowing

d) Expanding exports

Answer: b

21. A proper interest rate structure should:

a) Discourage savings

b) Promote speculation

c) Encourage savings and investment

d) Increase inflation

Answer: c

22. Very high interest rates may lead to:

a) High investment

b) Low economic growth

c) Stable inflation

d) High employment

Answer: b

23. Priority sector lending mainly supports:

a) Luxury industries

b) Agriculture and SMEs

c) Stock markets

d) Foreign banks

Answer: b

24. Improving payment systems mainly helps in:

a) Increasing taxes

b) Faster and safer transactions

c) Reducing savings

d) Increasing inflation

Answer: b

25. Advisory role of the central bank involves:

a) Lending to public

b) Guiding government on economic policy

c) Managing elections

d) Regulating trade

Answer: b