Citibank NA, a subsidiary of Citigroup, Inc., stands as one of the foremost global financial institutions, tracing its roots back to the early 19th century. Established in 1812 as the City Bank of New York, it has evolved over the centuries into a multifaceted entity offering a wide array of financial services to individuals, businesses, and governments worldwide.

Representative: Mr. Md. Moinul Huq

Designation: Citi Country Officer-Bangladesh

Address: 8, Gulshan Avenue,

Gulshan-1, Dhaka-1212.

Phone: 09666992119 +880 9612991215

Web: http://www.asia.citibank.com/bangladesh

[wptabs id=”14874″]

Citibank N. A. opened its representative office in Bangladesh in 1987 and full-service branch in 1995. The company offers a broad range of financial products and services to corporates, financial institutions and public sector clients, including its award-winning cash management, trade services, agency and trust, and direct custody and clearing solutions. The Institutional Clients Group (ICG) is organized into 4 groups for Citi Bangladesh: corporate & investment banking, markets, treasury and trade solutions and securities and fund services. The ICG advises companies, financial institutions, governments, nonprofit organizations as well as institutional investors are on the best ways to realize their strategic objectives.

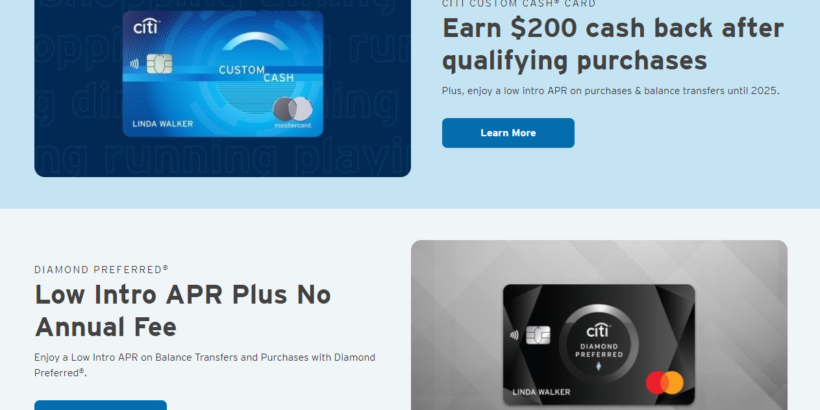

Citibank’s core offerings encompass retail banking, corporate and investment banking, wealth management, and institutional services. In the realm of retail banking, Citibank provides a comprehensive suite of products and services tailored to meet the diverse needs of its individual clients. From basic checking and savings accounts to credit cards, mortgages, and personal loans, Citibank offers a full spectrum of financial solutions designed to empower its customers to achieve their financial goals.

Moreover, Citibank’s corporate and investment banking arm serves as a strategic partner to corporations, governments, and institutional clients worldwide. Leveraging its global network and expertise, Citibank offers a wide range of services, including mergers and acquisitions, capital raising, risk management, and advisory services. Whether it’s facilitating complex cross-border transactions or providing strategic insights, Citibank’s corporate and investment banking division plays a pivotal role in driving economic growth and fostering innovation across industries.

In the realm of wealth management, Citibank caters to high-net-worth individuals and families seeking personalized financial guidance and investment solutions. Through its team of seasoned professionals and comprehensive wealth management platform, Citibank offers a holistic approach to wealth preservation and growth. From investment advisory services to estate planning and philanthropic solutions, Citibank’s wealth management division is committed to helping clients navigate the complexities of wealth management with confidence and clarity.

Furthermore, Citibank’s institutional services encompass a broad range of offerings tailored to meet the needs of institutional investors, including pension funds, sovereign wealth funds, and asset managers. Whether it’s custody and fund services, securities lending, or prime brokerage, Citibank provides institutional clients with the tools and expertise they need to navigate today’s dynamic and interconnected financial markets.

Beyond its core business activities, Citibank is committed to driving positive social and environmental impact through its corporate citizenship initiatives. From promoting financial inclusion and literacy to supporting sustainable development projects, Citibank is dedicated to leveraging its resources and expertise to create meaningful change in the communities it serves.

Citibank, officially known as Citibank N.A., stands as one of the world’s largest and most influential financial institutions. With a history spanning over two centuries, Citibank has evolved into a global powerhouse, offering a wide range of financial services to millions of customers worldwide.

Established in 1812 as the City Bank of New York, Citibank has its roots deeply entrenched in the economic landscape of the United States. Over the years, it has weathered through economic downturns, financial crises, and regulatory changes, emerging stronger and more resilient each time. Throughout its history, Citibank has played a pivotal role in shaping the modern banking industry, pioneering innovative financial products and services that have transformed the way people manage their money.

As a subsidiary of Citigroup, one of the largest financial services firms in the world, Citibank operates across multiple continents, serving customers in over 160 countries. Its extensive global network comprises thousands of branches, ATMs, and digital banking platforms, ensuring convenient access to banking services for individuals, businesses, and institutions alike.

Citibank’s diverse portfolio of products and services caters to the diverse needs of its customers. From personal banking solutions such as savings accounts, checking accounts, and credit cards to corporate banking services including corporate lending, cash management, and trade finance, Citibank offers a comprehensive suite of financial products tailored to meet the evolving needs of its clientele.

In addition to traditional banking services, Citibank is also a major player in the investment banking and wealth management sectors. Through its investment banking arm, Citibank provides a wide range of advisory, underwriting, and financing services to corporations, governments, and institutional investors globally. Its wealth management division offers personalized investment advice, portfolio management, and financial planning services to high-net-worth individuals and families, helping them achieve their long-term financial goals.

In recent years, Citibank has embraced digital innovation to enhance the customer experience and drive operational efficiency. Its robust online and mobile banking platforms enable customers to manage their finances conveniently from anywhere in the world. Furthermore, Citibank has invested heavily in technologies such as artificial intelligence, data analytics, and blockchain to streamline processes, mitigate risks, and deliver personalized services to its customers.

Despite its global reach and technological prowess, Citibank is not immune to challenges. Like other financial institutions, it faces regulatory scrutiny, cybersecurity threats, and market volatility. Moreover, the emergence of fintech startups and non-traditional competitors poses a threat to Citibank’s market dominance, compelling the institution to continuously innovate and adapt to stay ahead of the curve.

Looking ahead, Citibank remains committed to its mission of enabling progress and economic growth through responsible banking practices. By leveraging its global presence, financial expertise, and technological capabilities, Citibank aims to empower individuals, businesses, and communities to thrive in an ever-changing world of finance. With a rich heritage of innovation and a relentless focus on customer satisfaction, Citibank is poised to continue shaping the future of banking for generations to come.

In conclusion, Citibank NA stands as a beacon of stability, innovation, and excellence in the global banking industry. With its rich history, global footprint, and diverse portfolio of products and services, Citibank continues to empower individuals, businesses, and communities to thrive in an ever-changing world. As it embarks on its journey into the future, Citibank remains steadfast in its commitment to delivering exceptional value and fostering long-term relationships built on trust, integrity, and reliability.

Our Banking franchise is organized around three lines of business: Investment Banking, Corporate Banking and Commercial Banking. The unified Banking & International organization oversees the local delivery of the full firm to clients in each of the 95 markets where Citi has an on-the-ground presence.

Investment Banking

The Investment Bank provides advisory, debt and equity capital markets solutions for corporations, governments and financial institutions.

Corporate Banking

The Corporate Bank serves as the conduit of Citi’s full product suite to clients through holistically managed relationships across our unparalleled network.