The Central Bank of the Republic of Azerbaijan: An In-Depth Overview

Introduction

The Central Bank of the Republic of Azerbaijan (CBA) plays a crucial role in the economic structure of the country. Established with the goal of maintaining financial stability, promoting a stable currency, and ensuring the effective functioning of the financial system, the CBA’s work extends across a broad range of regulatory, monetary, and financial activities. This essay explores the various facets of the CBA, including its history, mission, vision, values, structure, functions, and key policies. We will also analyze its role in regulating the economy, maintaining exchange rate stability, and its place in Azerbaijan’s broader economic landscape.

History of the Central Bank of the Republic of Azerbaijan

The Central Bank of the Republic of Azerbaijan was founded in 1992, following Azerbaijan’s independence from the Soviet Union. During the Soviet era, Azerbaijan was part of the larger Soviet economic system, with the Soviet Union’s central banks handling financial matters for the republic. However, with independence came the need for a domestic central banking system that would address the specific financial needs of Azerbaijan and navigate the challenges of transitioning to a market economy.

In the early years of its operation, the CBA had to tackle numerous challenges, such as hyperinflation, a lack of a developed financial infrastructure, and the absence of experience in central banking. However, with the support of international financial organizations and the implementation of progressive economic reforms, the CBA gradually strengthened its institutional framework and became a key pillar of Azerbaijan’s economic management.

Over time, the CBA’s role expanded to include maintaining currency stability, ensuring the soundness of the banking system, managing foreign exchange reserves, and shaping the country’s monetary policy. Through these initiatives, the CBA contributed significantly to the development of Azerbaijan’s financial sector.

About the Central Bank of Azerbaijan

The Central Bank of the Republic of Azerbaijan is a national central bank tasked with ensuring the financial stability and integrity of the country’s monetary system. It is an independent institution, which operates under the supervision of Azerbaijan’s government, yet has the autonomy to manage monetary policy in accordance with its objectives. The CBA’s primary functions include managing the country’s monetary policy, issuing national currency (the Azerbaijani manat), regulating financial institutions, maintaining foreign exchange reserves, and acting as the government’s banker.

The CBA’s work is instrumental in fostering a stable macroeconomic environment conducive to economic growth. It also plays a key role in international financial cooperation, representing Azerbaijan in various regional and global financial bodies.

Mission, Vision, and Values

- Mission: The mission of the Central Bank of Azerbaijan is to maintain price stability, safeguard the stability of the financial system, and contribute to the sustainable development of the economy. The CBA aims to foster a sound and efficient monetary system to support the economic well-being of the country and improve the living standards of its citizens.

- Vision: The vision of the CBA is to become an institution that is recognized for its independence, credibility, and effectiveness in promoting monetary and financial stability. The CBA envisions itself as a central player in Azerbaijan’s economic modernization, developing financial tools and policies that contribute to the nation’s sustainable growth.

- Values: The CBA operates with core values of transparency, accountability, and integrity. The institution is committed to fostering trust with the public and market participants by ensuring the clear and effective implementation of its policies.

Headquarters and Organizational Structure

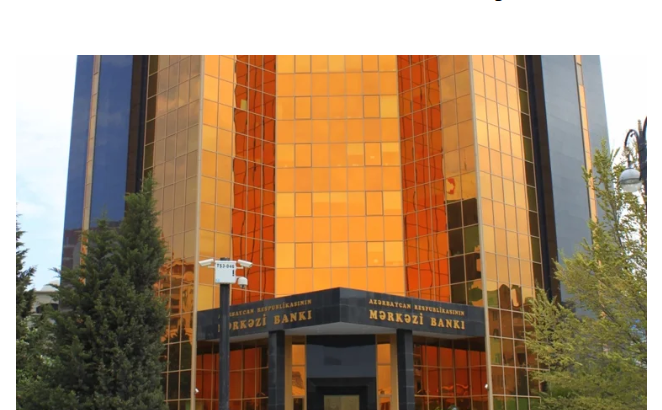

The headquarters of the Central Bank of Azerbaijan is located in Baku, the capital city of the country. This central location allows the CBA to coordinate with other governmental bodies, financial institutions, and international organizations that are critical to its operations.

The CBA has a structured organization that includes various departments and divisions, each responsible for specific areas of its functions, such as monetary policy, foreign exchange management, banking supervision, and economic analysis. The bank’s organizational structure ensures that each department can carry out its specialized tasks while maintaining a holistic approach to economic management.

List of Governors of the Central Bank of Azerbaijan

The governance of the CBA is led by the Governor, who is appointed by the President of Azerbaijan. The Governor is responsible for overseeing the overall direction and operations of the Central Bank. Below is a list of the key individuals who have served as the Governors of the Central Bank of Azerbaijan:

- Alim Guliyev (1992-2000)

- Farhad Aliyev (2000-2005)

- Elman Rustamov (2005–Present)

Each of these individuals has played a vital role in shaping the monetary policy framework and financial system of Azerbaijan.

Year of Foundation

As previously mentioned, the Central Bank of the Republic of Azerbaijan was founded in 1992, following the country’s declaration of independence from the Soviet Union. This marked the beginning of Azerbaijan’s journey to establish its own central banking system, separate from the Soviet structure.

Present Reserves

The Central Bank of Azerbaijan manages the country’s foreign exchange reserves, which are essential for ensuring the stability of the national currency and supporting foreign trade. These reserves provide the CBA with the capacity to intervene in the foreign exchange market, if necessary, to stabilize the exchange rate of the Azerbaijani manat.

As of the latest data, Azerbaijan holds significant foreign exchange reserves, though the exact figure fluctuates due to changes in commodity prices, particularly oil, which constitutes a large portion of Azerbaijan’s export revenues. These reserves are managed in a way that seeks to protect the economy from external shocks and to maintain investor confidence.

Regulation and Monetary Policy

The CBA plays a key role in the regulation of Azerbaijan’s banking sector. It establishes and enforces standards for commercial banks and other financial institutions, ensuring that they operate in a sound and transparent manner. One of the most important regulatory roles of the CBA is ensuring that financial institutions maintain adequate levels of capital and liquidity to support a stable banking system.

Monetary Policy is another key function of the Central Bank. Through its management of interest rates, reserve requirements, and other instruments, the CBA aims to influence inflation rates, economic growth, and employment levels. The CBA’s monetary policy decisions have far-reaching implications for the Azerbaijani economy, as they impact everything from the exchange rate to borrowing costs for businesses and consumers.

The policy framework is designed to be flexible, adapting to the evolving economic environment. The CBA monitors key economic indicators such as inflation, unemployment, and GDP growth, adjusting its monetary policy tools to maintain economic stability.

Key Departments and Functions

The CBA operates through several specialized departments that carry out a range of functions critical to its mandate. Some of the primary departments include:

- Monetary Policy Department: Responsible for formulating and implementing the country’s monetary policy.

- Financial Market Supervision Department: Oversees the operations of commercial banks, insurance companies, and other financial institutions.

- Foreign Exchange Department: Manages the country’s foreign exchange reserves and monitors the foreign exchange market.

- Research and Economic Analysis Department: Provides data and analysis that inform the decision-making process of the CBA.

- Legal Department: Ensures that the CBA’s activities comply with relevant laws and regulations.

- Public Relations and Communications Department: Manages the CBA’s communications with the public, media, and other stakeholders.

Each of these departments is integral to the successful operation of the CBA and supports its overall objectives.

Exchange Rate Policy

The CBA’s exchange rate policy plays a significant role in maintaining economic stability. Azerbaijan has a floating exchange rate system, which means that the value of the Azerbaijani manat is determined by the market forces of supply and demand. However, the CBA actively intervenes in the currency market to smooth excessive volatility and ensure that the exchange rate remains within a range that is conducive to the overall health of the economy.

A stable exchange rate is vital for foreign trade, investment, and inflation control, all of which are key areas of focus for the Central Bank. By managing the exchange rate, the CBA helps minimize the risks associated with foreign exchange fluctuations, which can have serious consequences for the nation’s economy.

Number of Employees

As of the latest data, the Central Bank of Azerbaijan employs over 1,000 individuals. These employees are spread across various departments, working together to implement the CBA’s policies and maintain the stability of the financial system. The CBA emphasizes professional development and continuous training to ensure that its staff remains equipped to handle the complexities of modern central banking.

Conclusion

The Central Bank of the Republic of Azerbaijan has evolved significantly since its founding in 1992. Over the years, it has developed into a modern and capable institution that plays a central role in the country’s economic management. Through its functions in regulating the financial system, implementing monetary policy, managing foreign exchange reserves, and ensuring the stability of the currency, the CBA has contributed significantly to the growth and development of Azerbaijan’s economy.

As Azerbaijan continues to grow and integrate into the global economy, the Central Bank will undoubtedly remain at the heart of the nation’s financial system, shaping the future of its economic policies and maintaining stability in an ever-changing global environment. Through its commitment to transparency, accountability, and the principles of effective governance, the CBA stands as a testament to Azerbaijan’s progress since its independence and its forward-looking economic strategy.